The Bitcoin Halving is the most important recurring event for Bitcoin. Every four years, it sparks both excitement and heated debates around whether it really matters or not. And investors worldwide are asking themselves the one and only question: Is now a good time to buy Bitcoin? As the Bitcoin Halving 2024 approaches, let’s take a look at all those questions.

In this blog post, you will learn about the mechanics of the Bitcoin Halving. We look into its potential impact on Bitcoin’s price, and what makes the 2024 Halving particularly special.

What is the Bitcoin Halving?

Bitcoin’s inception in 2009 represented a paradigm shift in how we perceive and transact value. The decentralized, peer-to-peer nature of the first cryptocurrency is what makes it unique. To pull this amazing feat off, Bitcoin relies on a process known as Bitcoin mining. Highly specialized computers add new transactions to the Bitcoin network. For this effort, miners are rewarded with newly minted Bitcoins. However, this reward doesn’t stay constant. Roughly every four years, or more specifically, every 210,000 blocks, this reward is cut in half. This event is known as the Bitcoin Halving.

So at the heart of Bitcoin’s design is a mechanism that ensures that Bitcoin gets scarcer as time progresses. That’s part of the reason some Bitcoiners like to refer to Bitcoin as ‘number go up technology’. Up until the first Bitcoin Halving in November 2012, this reward, the so-called ‘Block Reward’, was 50 BTC. In other words: Every ten minutes, the miner who added the latest block received 50 BTC. Afterward, the reward was halved to 25 BTC, then in September 2016 to 12.5 BTC, and so on. Currently, in September 2023, the block reward is at 6.25 BTC. This not only ensures the digital currency’s scarcity but also mimics the deflationary attributes of precious resources like gold.

Why does this Bitcoin Halving occur? It’s coded into Bitcoin’s DNA, ensuring that there will never be more than 21 million Bitcoins in existence. The Halving ensures Bitcoin’s scarcity. This is a stark contrast to fiat currencies, which can be printed without limit. Often leading to their devaluation and rampant inflation, as witnessed in various economies worldwide.

How are Bitcoin Halvings impacting the Bitcoin price?

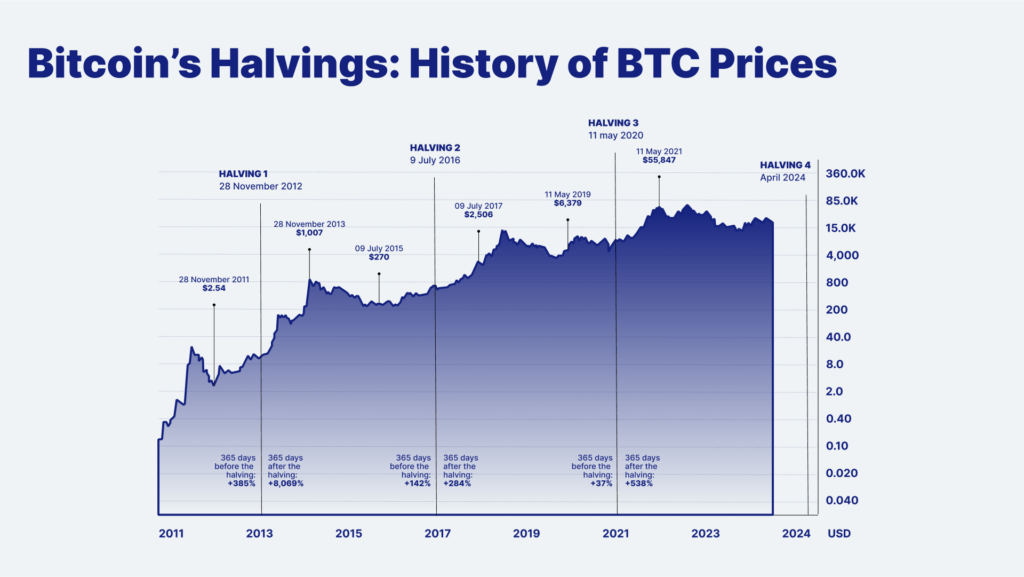

Historically, the Bitcoin Halving has been a significant event regarding Bitcoin’s price action. Reducing rewards for miners cuts the inflow of new Bitcoins into the market. This scarcity, combined with a constant or increasing demand for Bitcoin, typically creates upward pressure on the price. And, of course, there is also a psychological effect. Many people turn more optimistic before and around Halving events.

Substantial bull runs followed previous Bitcoin Halvings in 2012, 2016, and 2020. It’s important to note that many other factors can influence Bitcoin’s price. Including global economic conditions, regulatory news, technological advancements, and market sentiment. The correlation between Bitcoin Halving events and Bitcoin price surges is powerful, but not necessarily causative.

Bitcoin is still a young, emerging asset class. After just a bit more than a decade of fast-paced growth and a handful of Bitcoin Halvings under its belt, we still don’t have a lot of data to look at. It’s quite likely that the effects of this 4-year event will become less and less impactful as years and decades pass by.

What can we learn from previous Bitcoin Halvings?

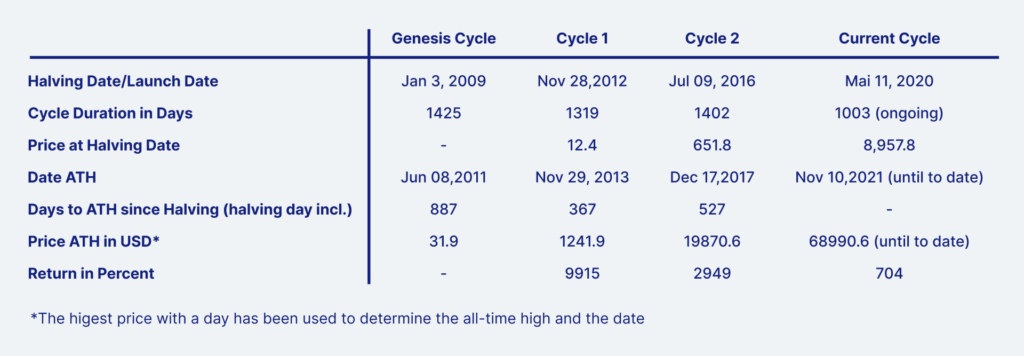

The current Bitcoin Halving Cycle started in May 2020. It’s only the third one, since the genesis Cycle that started in January 2009, and Cycle 1 and 2, which started in November 2012 and July 2016. The most impressive returns were delivered during Cycle 1: Between November 2012 and July 2016, Bitcoin delivered a staggering 9915 percent return. Followed by still very impressive returns of 2949 percent in Cycle 2 and 704 percent (so far) in Cycle 3.

One thing that is a repeating pattern in each Bitcoin Halving is the Bitcoin price typically rises leading up to the Halving, and then plateaus or slightly drops right after. And then shows a significant increase after around 9 to 15 months.

As already mentioned, past events can’t be used to predict the future. We may know more about how Bitcoin Halving Cycles impact the Bitcoin price in a couple of years or decades.

What’s special about the upcoming Bitcoin Halving 2024?

Each Bitcoin Halving is unique, given the evolving context of the Bitcoin industry and global economics. However, the upcoming Bitcoin Halving in 2024 is expected to be especially interesting. Let’s look at some of the things that make the upcoming Bitcoin Halving special.

- ETFs and institutional interest: We’re currently very close to taking a big step forward in terms of global recognition of Bitcoin’s value proposition. Banking failures, crypto scams, high inflation rates, and a lack of trust in established institutions are among the things that make more and more private and institutional investors take a closer look at Bitcoin. Now with Bitcoin ETFs on the horizon in the U.S., Bitcoin-Only is becoming more and more recognized in the financial world.

- Bitcoiner politicians: We’re seeing more and more politicians take an openly supportive stance on Bitcoin. This development was still unthinkable during the last Bitcoin Halving that happened in May 2020. We have candidates who want to run for U.S. who openly support Bitcoin, pro-Bitcoin politician Javier Milei won the presidential primary in Argentina, and of course, we have El Salvador, whose bonds skyrocketed in 2023.

- Interest rate pivot: Central banks have raised interest rates faster than ever before due to rampant inflation in both emerging and developed economies. Now that consumer price inflation (CPI) is falling in most countries, a pivot or at least a pause in terms of inflation rates seems possible. This could act as a catalyst for a bullish breakout for all financial assets, including Bitcoin.

Conclusion and final thoughts

The upcoming Bitcoin Halving 2024 is poised to be yet another monumental event in the emergence of Bitcoin as a young, unique monetary good. While historical patterns suggest a positive price movement in the aftermath, it’s critical to understand that Bitcoin, like any financial asset, operates within a complex ecosystem of economic, technological, and social variables. The 2024 Halving will be influenced not just by the coded reduction in block rewards for Bitcoin miners but also by the backdrop of an evolving financial landscape — with rising institutional interest, supportive political stances, and macroeconomic shifts.

As with every significant milestone in Bitcoin’s journey, the 2024 Halving presents both opportunities and uncertainties. While no one can predict the future with absolute certainty, the event undeniably reiterates Bitcoin’s core proposition: a decentralized, finite, and deflationary store of value in a world where traditional economic paradigms are being continuously challenged. Whether you’re a seasoned Bitcoiner who regularly stacks Sats, a curious observer, or someone on the fence about Bitcoin, the next Bitcoin Halving will be exciting for you in one way or another.

FAQ

How many Bitcoins will be awarded to miners after the 2024 Halving?

After the 2024 Halving, miners will receive 3.125 Bitcoins as a reward for every block mined, down from the current 6.25 Bitcoins.

When exactly will the Bitcoin Halving in 2024 occur?

The exact date cannot be predicted with certainty, as it depends on the mining of the 210,000 blocks since the last Halving. However, based on current projections, it’s anticipated to occur in April 2024.

Which effect will the Bitcoin Halving 2024 have on the Bitcoin price?

There are various price-predictions floating around. Standard Chartered, one of the largest British banks, is quite bullish and predicts that the bitcoin price could reach $50,000 by the end of 2023, and $120,000 by the end of 2024. The controversial Stock-to-Flow (S2F) model of anonymous Bitcoin analyst PlanB puts the main support base at around $100,000. It’s very important to take price predictions with a grain of salt, as no one can predict the future.

How many more Bitcoin Halvings will there be in total?

There will be Halvings until the last fraction of a Bitcoin has been mined, which is expected to be in the year 2140. After that, no more new Bitcoins will be unlocked by Bitcoin miners. After that, the security of the Bitcoin network will be ensured through transaction fees.

To start buying Bitcoin and experience our service, download the Relai app for Android or iOS.

Information about the author