Read on to learn what the Bitcoin halving is and how it has historically affected the price performance of bitcoin.

The Bitcoin Halving Explained

Don’t worry! The Bitcoin halving doesn’t mean a halving in the price of bitcoin.

The Bitcoin halving refers to a reduction in the block reward that Bitcoin miners receive every time they mine a new block in the Bitcoin blockchain.

New bitcoin are created through a process called mining. Bitcoin miners use specialized mining hardware to validate and verify bitcoin transactions, creating new blocks that are added onto the Bitcoin blockchain.

In return for securing the Bitcoin network, miners receive a reward in the form of transaction fees and newly created bitcoin every time they mine a new block. This is where the Bitcoin halving comes into play.

Every 210,000 blocks, which take around four years to mine, the Bitcoin block reward is halved. This reduces the rate at which newly mined bitcoin units are issued into the market. When Bitcoin was launched in 2009, the reward for mining a block was 50 bitcoin units.

To date, Bitcoin has undergone three successful halving events, with the first having taken place in 2012. The reward for mining Bitcoin currently stands at 6.25 BTC for every block mined. The next Bitcoin halving will occur in 2024.

In total, there will be 32 Bitcoin halving events, with the last halving taking place in 2140. By then, Bitcoin will have reached its maximum supply of 21 million BTC. At this point, miners will receive their reward in transaction fees paid by users as an impetus to continue validating transactions instead of new mined Bitcoin units.

Currently, the number of mined bitcoin stands at 18.87 million BTC. This leaves a mere 2.13 million bitcoin that needs to be mined over the next 119 years.

How Does It Affect the Price of Bitcoin?

Historically, Bitcoin block reward reductions have resulted in massive surges in the price of bitcoin.

However, the post-halving rallies didn’t occur immediately. In fact, the price rallies occurred months after each halving event.

For example, the first halving that took place on November 28, 2012, saw the price of bitcoin increase from $12 to $1,217 by November 28, 2013.

On July 9, 2016, when the second halving took place, the price of bitcoin was a mere $647. This would later soar to $19,800 by December 17, 2017. And even though this price would later drop to $3,276 one year after, it was still 506% higher than the pre-halving price. The most recent halving, which took place on May 11, 2020, saw the price of bitcoin increase from $8,787 to $64,507 on April 14, 2021.

While the past halving events have created significant surges in the price of bitcoin, there is no guarantee that there will be a price increase come 2024, which is when the next Bitcoin halving event will take place.

However, as a Bitcoin investor, it’s important to take note of halving events as they have always had a significant impact on the price of bitcoin.

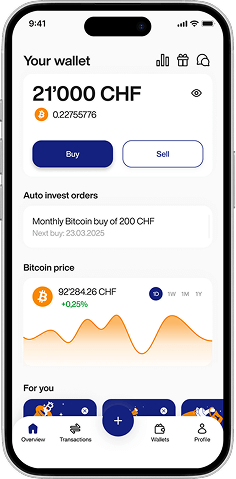

To start buying bitcoin, download the Relai app from the Google Play Store or Apple App Store today!