We’re excited to announce the launch of a powerful new feature: Bitcoin-backed loans. Also known as Lombard loans, this financial instrument enables Bitcoin holders to spend CHF or EUR without having to sell their Bitcoin. In partnership with Sygnum Bank— a Swiss digital asset bank —Relai is bringing a new level of financial flexibility to their HNWI and SME clients.

With this launch, Relai became the first Bitcoin Broker in Europe to offer Bitcoin-collateralized lending. This means Relai Private and Business clients can now unlock liquidity without ever having to part with their Bitcoin.

Why Bitcoin-Backed Loans?

Many investors and companies are seeking to finance projects, invest in new opportunities, or simply need access to cash without having to liquidate their Bitcoin holdings. Relai Private’s Bitcoin-backed loan offering provides the best of both worlds:

- Maintain exposure to Bitcoin’s potential upside

- Avoid triggering taxable events by not selling

- Skip the stress of re-entering the market at higher prices

- Stay entirely within the Bitcoin ecosystem

“At Relai, we’re building the future of Bitcoin-focused financial services. This partnership with Sygnum Bank is a huge milestone for us as a Startup. Bitcoin-backed loans are a game-changer for our wealthy clients, providing them with access to cash without the need to sell their Bitcoin. We are seeing a strong demand for that service, especially from high-net-worth individuals and small to medium-sized businesses.”

— Julian Liniger, CEO & Co-Founder of Relai

With Relai and Sygnum, your Bitcoin becomes more than a long-term store of value—it becomes a versatile financial tool.

“We’re proud to partner with Relai, a company that shares our commitment to simplicity, transparency, and Bitcoin-first innovation. This collaboration brings the strength of our regulated credit infrastructure to new groups of private investors, empowering them to unlock liquidity without compromising their long-term vision.”

— Benedikt Koedel, CFA, Head Credit & Lending at Sygnum Bank

Who Can Use Bitcoin-Backed Loans?

To access this service, you must be a qualified private investor under the Swiss Financial Services Act (FinSA). This typically includes individuals who:

- Possess professional or financial sector experience and/or relevant education, and

- Hold at least CHF 500,000 in financial assets

- Are interested in a minimum deposit or trading volume of CHF 100,000

How Long Does Onboarding Take, What Do I Need to Do, and What Are the Ins and Outs of the Loan Agreement?

The terms of this partnership are straightforward. If you bring Bitcoin and want a loan, contact our business team. Once they respond, they will establish the verification and onboarding process. The requirements are as follows:

- Minimum Age: 18 years

- Residency: Available to clients in most jurisdictions except for restricted countries (e.g., U.S., certain high-risk countries)

- Accepted IDs: Valid passport or national ID from approved countries

- Source of Funds: Must be verifiable and consistent with declared wealth

- Initial Deposit Requirement: Typically CHF 100,000 or equivalent

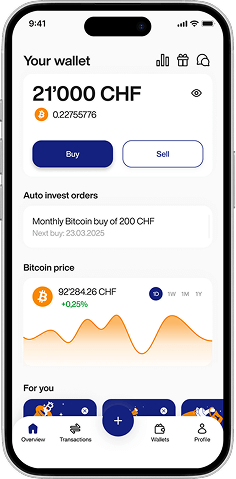

If you have all your documents ready, you’ll be onboarded within a few business days and ready to take the next steps with your Bitcoin lending. You’ll be onboarded to our excellent lending platform, where you can set up your first loan.

All loans have a minimum term of 12 months and are backed by a loan-to-value (LTV) ratio of up to 40% for Bitcoin.

If you want to know more about Bitcoin-backed loans or have any questions, please contact our Relai Private and Relai Business teams.

They would be happy to help you out and explain everything in detail.

Swiss Quality, Bitcoin Simplicity

This new offering is more than just a loan—it’s a reflection of our vision at Relai: to be the most complete, secure, and user-friendly Bitcoin-only app in Europe.

With Swiss-made security, regulatory clarity, and an intuitive user experience, we’re putting powerful financial tools into the hands of Bitcoin believers, without compromising the core ethos of decentralization and long-term ownership.

Note: Relai services are exclusively recommended for residents of Switzerland and Italy. None of this content constitutes financial advice. Always conduct your own research before investing in digital assets.

FAQ

Does Relai offer crypto lending or borrowing services?

No. Relai AG does not offer lending or borrowing of bitcoin or any other crypto-assets.

We are a non-custodial Bitcoin-only app based in Switzerland. This means:

- We do not hold customer funds

- We do not lend or re-use your bitcoin

- You are always in full control of your money.

That said, Relai AG currently collaborates with Sygnum Bank, a FINMA-regulated Swiss bank, to offer bitcoin-backed lending services. These services are fully separate from Relai’s core app and are clearly indicated during the user experience.

Relai AG is committed to full regulatory compliance as part of our MiCA license application and we are transparent about the services we offer — or don’t. The terms and conditions for accessing such a service are defined solely by the bank.