Across the globe, countries such as Venezuela, Lebanon, Argentina, and even Turkey, are experiencing the harsh realities of hyperinflation. In these economies, the value of local fiat currencies is rapidly depreciating. As a result, the life savings of many are becoming worthless. But the threat isn’t confined to developing or emerging economies alone. Luckily, we now have Bitcoin to exit the fiat monetary system and as a way to protect us from inflation and currency debasement.

In this blog post, you’ll learn about currency devaluation, hyperinflation and how you can protect yourself with Bitcoin.

WHEN MONEY DIES: FROM WEIMAR TO VENEZUELA

Before we dive into the decline of fiat currencies, it’s essential to make yourself familiar with the concept of hyperinflation. Hyperinflation is an economic term that describes an extremely rapid or out-of-control inflation rate. It’s often defined as a situation where the inflation rate exceeds 50% per month. It’s more or less the death sentence for a national currency. The population loses trust in it and does everything in its power to get their hands on (potentially) harder store of values like the US dollar, gold, or Bitcoin.

One of the most infamous instances of hyperinflation occurred in Weimar Germany after World War I. The inflation rate of the German mark reached almost 30,000% per month by October 1923. This economic crisis wiped out people’s life savings and disrupted the entire German economy.

Today, the ghost of Weimar’s hyperinflation haunts several countries. In Venezuela, for instance, hyperinflation has been a reality for many years, with the International Monetary Fund reporting an inflation rate of 10,000,000% for 2019. In Zimbabwe, hyperinflation peaked in the late 2000s, reaching a staggering rate of almost 90 sextillion (10^21) percent per month. Meanwhile, Argentina struggled in mid 2023 with an inflation rate of over 100% and rising, severely eroding the value of the Argentine Peso.

WHAT ARE INFLATION AND CURRENCY DEBASEMENT?

The phenomenon of currency devaluation and (price) inflation are not exclusive to economies that experience hyperinflation. In fact, it’s an integral part of our current financial system, and driven by government spending and private as well as national debt. It impacts even the strongest of economies like the United States, Switzerland, or member states of the European Union.

Since 2021 we’re seeing an uptick in consumer price inflation in European countries. While the exact reasons for it is up for debate, it’s clear that purchasing power is eroding at a faster pace than the usual 2% per year.

The Euro, the common currency of many of the world’s most stable economies like Germany, France, Italy, Spain, or the Netherlands, is also affected by this. Since its inception in 1999, the Euro has lost a shocking 38% of its value. To put this into perspective: 1 Euro today can only purchase about 62% of what it could back in 1999.

Visualized, the decline in purchasing power looks like this, with a sharp acceleration since 2021:

And even the strongest fiat currency in the world, the US dollar, is not immune. The US dollar, considered the backbone of the global economy, has seen its purchasing power diminish significantly since the abandonment of the gold standard in 1971. Prior to this, each dollar was backed by a specific amount of gold. However, when the US transitioned to a fiat monetary system, where the dollar’s value is not tied to a physical commodity, this allowed for unlimited printing of money by the Federal Reserve.

As a result, the purchasing power of the dollar has fallen dramatically. According to the U.S. Bureau of Labor Statistics, the dollar has lost over 85% of its purchasing power since 1971. This means that what you could buy for $1 in 1971 would require nearly $7 today.

These alarming figures highlight a global trend – the steady devaluation of traditional fiat money systems. This degradation of trust in the fiat system, especially the US dollar as its strongest representative, is making the narrative of Bitcoin as an alternative form of currency increasingly compelling.

BITCOIN: HARD MONEY TO PROTECT YOUR WEALTH

In a world where fiat currencies continue to lose their value due to inflation, Bitcoin emerges as a resilient champion. This groundbreaking digital asset offers unique attributes that position it as the hardest, and potentially, the best form of money we’ve ever seen.

The concept of decentralization lies at the heart of Bitcoin. Unlike conventional currencies that are controlled and manipulated by centralized institutions such as governments or central banks, Bitcoin operates on a decentralized system, the blockchain. This decentralization implies that Bitcoin isn’t susceptible to the policy changes or economic whims that usually trigger inflation in traditional currency markets.

But the true power of Bitcoin is revealed in its scarcity. The number of Bitcoins that can ever exist is hard-capped at 21 million, a stark contrast to fiat currencies that can be produced without limit, often leading to their devaluation. This scarcity principle is embedded in the Bitcoin network through a process known as ‘mining.’ Furthermore, the rate at which new Bitcoins are mined is halved approximately every four years, further curbing any inflationary pressures.

This combination of decentralization and enforced scarcity underpins Bitcoin’s status as the hardest money in existence. As the global financial landscape grapples with instability and the repercussions of unrestrained money printing, Bitcoin’s robust and unyielding monetary policy makes it a beacon of financial resilience.

As such, it is not only a potential safeguard against the uncertainties of traditional monetary systems, but it also raises a compelling argument for being the best form of money humanity has ever seen.

HOW TO PROTECT YOU FROM INFLATION AND CURRENCY DEBASEMENT WITH BITCOIN

As we’ve explored, Bitcoin offers a promising safeguard against the persistent depreciation of fiat currencies. But how does one leverage this digital asset to protect their wealth? The process is simpler than you might expect.

- Understand Bitcoin: Knowledge is power, and this is particularly true when it comes to Bitcoin. Understanding the underlying technology of Bitcoin, how it operates, and why it holds value is crucial before investing. Several resources, from books to online courses, can guide you on this learning journey.

- Buy Bitcoin: Once you have a solid understanding of Bitcoin, you can begin to accumulate it. Given the volatility of Bitcoin, a common strategy is to ‘dollar-cost average’ your investments. This involves purchasing a set amount of Bitcoin at regular intervals, smoothing out your purchase price over time, rather than trying to time the market.

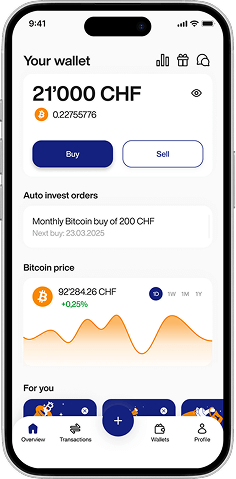

- Securely store your Bitcoin: Security is of paramount importance when it comes to Bitcoin. Digital wallets allow you to store, send, and receive Bitcoin. Some wallets offer robust security features such as encryption and backup options. Hardware wallets, considered the safest option, store your Bitcoin offline, away from potential hackers.

CONCLUSION

While fiat currencies worldwide continue to devalue, Bitcoin emerges as a ray of hope for many. This decentralized and finite currency can protect your wealth from inflation and financial instability, making it an investment worth considering.

To start buying bitcoin and experience our service, download the Relai app from the Google Play Store or Apple App Store (iOS app currently only available in Switzerland).