When it comes to bitcoin as an investment asset, however, it’s important to understand why the digital currency can be so volatile at times and why that isn’t something that should scare you as a long-term bitcoin investor.

Read on to learn more about why the price of bitcoin is so volatile.

Is Market Volatility Healthy?

Before we dive into bitcoin’s price volatility, let’s briefly discuss market volatility in general.

Market volatility has often been associated with heavy losses in the financial markets. This negative view is the consequence of the cyclic nature of financial markets that causes investors to experience sharp market corrections every few years.

While this cycle is repetitive, the good news is such cases of extreme downside market volatility are rare.

What is normally experienced in the markets on a daily basis is what you can call moderate volatility. For example, leading stock indices, such as EURO STOXX50, typically go up and down one to two percent on any given day.

Price volatility is a normal part of the global financial markets and only becomes a challenge for investors when markets drop sharply. But even then, most long-term investors remain largely unaffected by market downturns as they have an investment horizon of 10+ years.

What Causes Bitcoin Volatility?

The price of bitcoin is more volatile than stock indices, high-grade bonds, gold, and most other popular investment assets.

More and more market participants are investing in and trading the digital currency, fuelling its price growth but also its volatility. But the influx of new and different types of investors and speculators is not the only reason why the price of bitcoin is volatile.

Let’s take a look at some of the key drivers of the price of bitcoin that contribute to price volatility.

Bitcoin Headlines

Historically, bitcoin has been impacted by government regulations, geopolitical events, and even statements by prominent individuals and companies in the space.

In the early days of bitcoin, negative events such as the reported use of bitcoin on the dark web marketplace Silk Road in 2013 and the Mt.Gox exchange hack in 2014 resulted in price collapses.

While volatility was much higher in the early days of bitcoin when the digital currency made headlines, recent events have shown that the price of bitcoin remains heavily affected by headlines. For example, the price of bitcoin took a hit when Elon Musk tweeted that Tesla would no longer support bitcoin payments due to his environmental concerns s

Security Breaches

Digital asset exchange hacks have also contributed to bitcoin’s price volatility.

When a centralized bitcoin exchange experiences a security breach resulting in stolen bitcoin, cybercriminals will eventually try to sell their digital currency. In anticipation of that, the price of bitcoin usually drops as the market knows that there’s a large seller now.

High-Profile Bitcoin Adoption Cases

Every time a large corporation or a country buys bitcoin for its treasury or accepts it as a form of payment, the price of bitcoin typically experiences upside volatility.

For example, leading up to the day when bitcoin became legal tender in El Salvador, the price of bitcoin rallied substantially. When the likes of MicroStrategy and Tesla announced they were buying bitcoin as cash reserves for their balance sheets, bitcoin also rallied.

Lack of Clear Regulations

While Switzerland has a clear regulatory framework for digital assets, most countries don’t. The regulatory landscape keeps changing in many parts of the world as lawmakers and regulators are still trying to make sense of how to regulate an inherently decentralized asset class.

However, whenever the authorities in large economies hint at stricter bitcoin regulations, the price of bitcoin usually takes a hit. At the same time, when a large bitcoin economy passes bitcoin-friendly regulations, the price of bitcoin usually responds positively.

Geopolitical Turmoil

Bitcoin has established itself as a safe haven asset for individuals in countries with weakening local currencies.

Turkey, for example, has seen a tremendous increase in demand for bitcoin, following the sharp drop in the value of the Turkish lira versus other currencies.

The same can be said for several countries in South America, like Argentina and Columbia, which have had their fair share of economic woes.

While bitcoin continues to be more volatile than most traditional assets, it also comes with a substantial potential upside, as witnessed by its historical price progression. Many experts, therefore, argue that the high volatility is a small price to pay for the potential upside.

Auto-Invest in Bitcoin & Chill

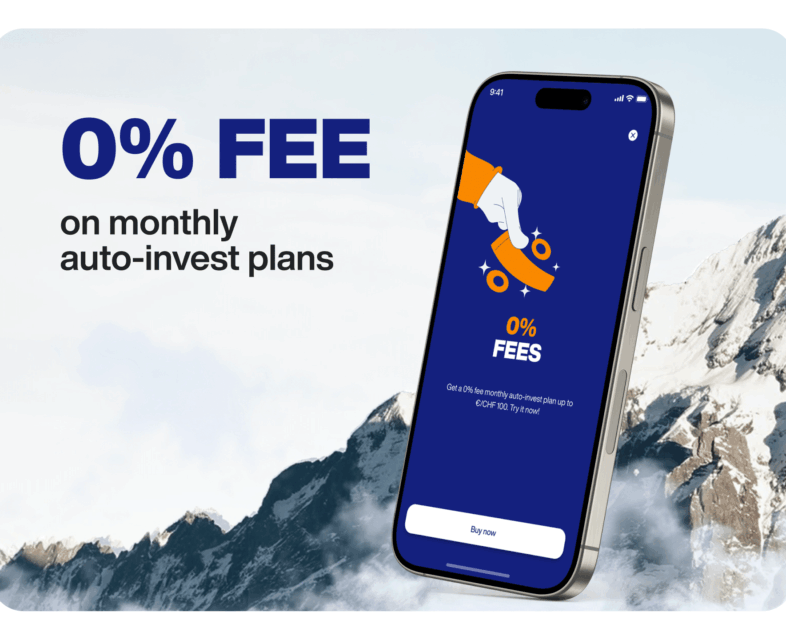

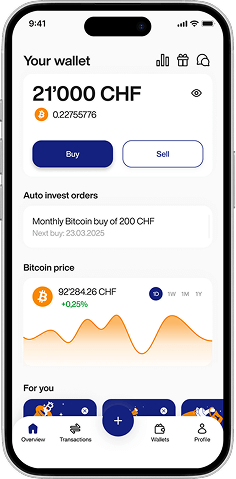

Arguably, the best way to invest in bitcoin without having to worry too much about short-term volatility is by automatically investing a fixed amount every month or week using a bitcoin savings plan.

That way, you are benefiting from the popular dollar-cost averaging investment strategy that allows you to smooth out price volatility by buying at regular intervals regardless of where the price of bitcoin is trading.

Using the Relai app, you can invest in bitcoin on a weekly or monthly basis, starting at EUR 25 in a fully automated manner.

To easily and securely invest in bitcoin, download the Relai app (Android / iOS) today.