Read on to discover a list of the top ten most common investment mistakes to avoid.

Not Investing At All

Arguably the biggest investment mistake you can make is not investing at all.

The money you are holding in your bank account slowly decreases in value because of inflation and the negative interest rates more and more banks are charging, making it very challenging to accumulate wealth by putting money aside in a savings account.

While this may have worked for our parents’ generation, the low-interest-rate environment we have come accustomed to in the last decade means the interest you are earning on your savings account will, in all likelihood, be lower than inflation. That means your money is actually becoming worth less by having it sit in a bank account.

The way to address this issue is by investing your money in assets such as stocks, funds, and bitcoin.

Investing in Something You Don’t Understand

Another common mistake you can make in your investing journey is investing in something that you yourself don’t understand.

It’s easy to get caught up in the hype of the latest meme coin or meme stock. Alternatively, it can be tempting to take advice from a friend who tells you that this stock he just bought will make him rich and you should get in too.

However, investing in something on a whim without conducting proper research could lead to serious losses. Before you make any investment, make sure you understand what you are investing in. Do your own research (DYOR) as the popular meme on Bitcoin Twitter says.

Putting All Your Eggs in One Basket

Ever heard of the saying “Never put all your eggs in one basket?” Well, that saying rings true when it comes to investing.

Diversifying your investment portfolio, i.e., buying a basket of assets such as stocks, real estate, commodities, and bitcoin, allows you to reduce risk while maximizing return.

Different asset classes behave differently, which means they don’t all go up and down together. For example, stocks and bonds tend to have a negative correlation, which means when stocks rally, bond prices tend to fall.

Bitcoin, for example, is largely uncorrelated to traditional assets, which makes it such a popular diversification asset.

Building a portfolio composed of several asset classes can ensure that when one asset class drops in value, the uncorrelated or negatively correlated asset classes in your portfolio will make up for (most of) the losses.

Letting Fear and Greed Drive Your Investment Decisions

As an investor, it’s important to have clear goals. Before you make your first investment should be clear about what you want to achieve, which will help you to develop the right investment strategy.

Once you have an investment strategy in place, for example, investing €100 worth of bitcoin and €100 worth of an ETF on a monthly basis, you are less likely to let fear and greed drive your investment decisions.

If the market is going up fast, it’s easy to become greedy and buy more than you should really be risking. At the same time, when the market experiences a sharp correction, it may be tempting to sell out of fear.

Having a clear investment plan in place will help you to avoid letting fear and greed drive your investment decisions.

Attempting to Time the Market

There’s a popular meme that says, “Time in the market is better than timing the market.” While empirical data do not necessarily back this statement, it highlights how difficult it is to time the market.

Timing the market refers to buying and selling an asset at the correct times to maximize profit.

While professional traders regularly manage to make money by timing the market, most private investors are better off buying and holding (and adding to their portfolio) instead of trying to buy and sell just at the right time.

The truth is, however, that even professional fund managers regularly underperform the market. If, instead of trying to time the market, they would have just bought their benchmark index, many fund managers would have generated a better return.

Unless you are willing to put in the time to become a full-time trader, the chance of successfully timing the market on a regular basis is rather slim. Therefore, it’s probably best for you to follow your investment strategy and regularly add to your portfolio to build wealth over time.

Obsessively Checking the Market Every Day

It’s tempting to want to watch the markets and see how your investments are doing. However, this isn’t the best idea.

While you can keep an eye on your investments, doing so obsessively can cause you to make rushed decisions that may negatively impact your investments.

Ideally, you want to have an investment strategy in place that grows your wealth over time by regularly adding more funds into your portfolio. That way you don’t have to obsess over daily price movements.

Taking Investment Advice from Social Media

While social media can be a great place to learn and interact with individuals you wouldn’t normally get to talk to, it’s probably the worst place to find investment advice.

There is a lot of misinformation and an endless amount of self-proclaimed investment “experts” on social media.

As a rule of thumb, never take financial advice from social media. If anything, research the person giving the investment advice you are considering to follow and see whether they are qualified experts with a good track record. As usual, do your own research.

Investing More Than You Can Afford to Lose

One of the most common mistakes you can make is to invest more than you can afford to lose.

It’s easy to let greed drive you, thinking purchasing that “hot stock” a friend recommended will make you rich overnight. While you shouldn’t act on your friend’s stock tips, should you decide to, make sure you never invest more than you can afford to lose.

That advice holds true for all investments you make. It’s not advisable to risk more than you can afford to lose. In case your investment portfolio suddenly drops in value, you may find yourself short of cash to cover bills.

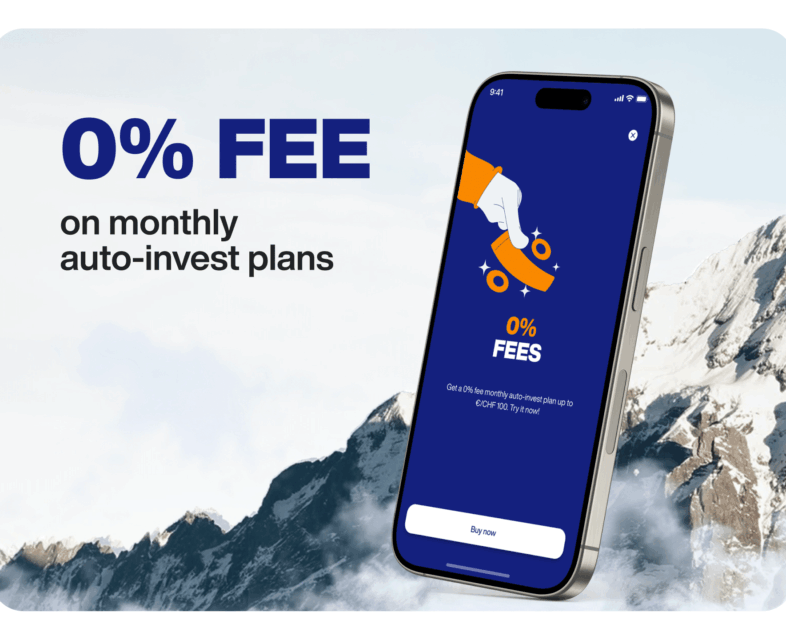

Forgetting About the Fees

High fees can reduce the value of your investments in the long run.

The type of fees you can incur as an investor include trade execution fees as well as withdraw and deposit fees (charged by your online broker), fund management fees (charged when you purchase a fund or ETF), and less obvious fees, such as the spread you pay for buying and selling.

While investing typically incurs some fees, make sure that you are clear about what the fees are and that they are low compared to other service providers. If your online brokerage account is charging fees you deem too high, switch to a cheaper broker.

Forgetting About Capital Gains Tax

Oh yes, you have to pay taxes on your investments too. You put money aside, take the risk of investing it in the capital markets, and the taxman gets their cut.

While taxes on investment differ from country to country, most investors have to pay capital gains tax which is a tax that is levied on the profits you make when you sell non-inventory assets such as bonds, stocks, real estate, property, and precious metals.

Every time you make a decision to sell your investment and have made a profit, don’t forget that capital gains tax will take some of your profits away.

To gain more information about how your investments have to be taxed, please speak to your tax advisor. Relai does not provide tax advice.

How to Avoid Making Common Investment Mistakes

The best thing you can do to avoid the majority of the investment mistakes we have listed in this guide is to have an investment plan and automate your investments.

Make a Plan

Failing to plan is planning to fail. Before you start investing, ask yourself why you want to invest, what you aim to achieve with your investment, and how much you are willing to invest to achieve your investment goal. Once you have a plan in place, you should stick to it so that you don’t get distracted by new “opportunities” or market corrections.

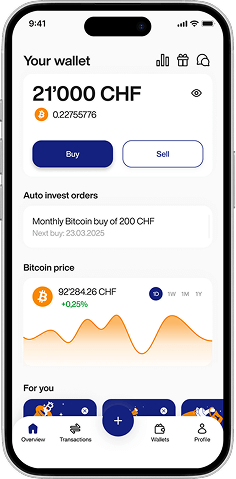

Automate Your Investments

Automating your investments using an app or an online investment platform to regularly add to your investment portfolio (in line with your investment strategy) is arguably one of the best ways to invest. Whether you are using a robo-advisor to buy ETFs or an app like Relai to set up a bitcoin saving plan, automation is a new investor’s best friend.

To start automating your bitcoin investments, download Relai (Android/ iOS) today.