Bitcoin’s price volatility can be frightening, especially for newcomers. However, there are tested and proven ways to protect yourself from market meltdowns like we are currently seeing. Holding your own Bitcoin keys is the most important one.

Read on to learn why it’s important to hold your own Bitcoin keys.

You might ask yourself: Which keys, and what do they have to do with Bitcoin? Well, public and private (cryptographic) keys are core elements of Bitcoin. A public key is like a mailbox: You can share it with others, for example, to receive packages (in our case bitcoin transaction). In order to actually open the packages, and gain access to your bitcoins, you need a private key.

Many services where you can buy bitcoin take care of both keys for you. This is convenient but has one major downside: You technically don’t own the bitcoin – the service you are using does.

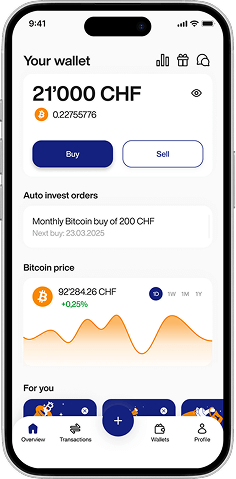

At Relai, we have a different approach and encourage holding Bitcoin the way it should be done: Users can either send bitcoins they purchase via our service to their Relai wallet OR can directly send them to any external Bitcoin wallet like for example a hardware wallet. No matter what you decide: You always hold your own keys.

Holding Your Own Bitcoin Keys Is Important – Especially During Meltdowns

The recent debacle with Celsius illustrated yet again that ‘Not Your Keys, Not Your Bitcoin’ is not just a meme. It’s a fundamental truth you need to be aware of as an investor. By handing your assets to a service like Celsius to let’s say earn interest on it, means that you don’t own your assets anymore.

Lured in by too-good-to-be-true interest rates, a lot of people felt they are missing out when they let their assets sit in their own wallets. Services like Celsius even encouraged users to not choose self-custody, and rather hand over their keys to them. What really happened at Celsius will be part of criminal investigations, but the short version is that they took funds from their users and used them to speculate. This risky hedge fund business model collapsed when prices came under pressure and users wanted ‘their’ assets back.

Use Relai And Stack Sats In Your Own Wallet

While many expected a rocket ship, investing in Bitcoin is after all still more like a rollercoaster ride. Stacking sats in your own wallet is the best way to protect yourself from uncertainties and counterparty risk. Especially when you use cost averaging by for example setting up a savings plan, which at Relai is possible from as little as €50.

Ready to get started?

Investing in bitcoin with Relai is so simple, it only requires three basic steps:

- 1. Download Relai from the App Store or Play Store.

- 2. Put in the amount of bitcoin (BTC) you want to buy.

- 3. Make a bank transfer to pay for your bitcoin purchase.

You simply download the app, put in the amount of bitcoin you want to buy weekly or monthly, and then set up a recurring bank payment to Relai.

That’s it! That’s how easy automatic investing in bitcoin without identification or account creation can be.