An individual or group created Bitcoin by the pseudonym Satoshi Nakamoto. It remains a mystery who this person or group was. But we know of someone who played an integral part in bringing Bitcoin to life: Hal Finney. He was the first person to receive a Bitcoin transaction from Satoshi Nakamoto. He is also considered one of the most influential people in the early days of Bitcoin. Hal was a cryptographer who developed the theoretical precursor to cryptocurrency, Reusable Proof of Work (RPOW).

In this blog post, we explore 12 top quotes, showcasing his thoughts on Bitcoin, its potential as an investment, and its future as a reserve currency.

1. The computer can be used as a tool to liberate and protect people, rather than to control them.

In November 1992, over 17 years before receiving the first-ever Bitcoin transaction from Satoshi Nakamoto, Hal Finney wrote the above sentence in a mailing list with other cryptography enthusiasts. In the text, Hal also mentions that he stumbled upon David Chaum’s ideas about digital cash that preceded Bitcoin. Hal continued: “Unlike the world of today, where people are more or less at the mercy of credit agencies, large corporations, and governments, Chaum’s approach balances power between individuals and organizations.”.

2. Bitcoin seems to be a very promising idea. I like the idea of basing security on the assumption that the CPU power of honest participants outweighs that of the attacker.

The above quote is taken from Hal Finney’s reply to Satoshi Nakamto’s initial email to the cryptography mailing list. On October 31, 2008 Satoshi sent a link to the legendary scientific paper titled Bitcoin: A Peer-to-Peer Electronic Cash System to the mentioned mailing list. Hal’s mail came after other participants were skeptical about Satoshi’s paper. However, Hal was unsure about the paper, and also wrote: “Unfortunately I am having trouble fully understanding the system. The paper describes key concepts and data structures, but does not clearly specify the various rules and verifications that the participants in the system would have to follow.“

3. Running bitcoin.

Satoshi started the Bitcoin network on January 3, 2009, by creating the ‘genesis block’. On January 9, 2009 Satoshi officially released the open-source Bitcoin software. Hal Finney downloaded the software on its release day. On January 11, 2009 Hal tweeted the above tweet, which is now a legendary first public life sign of Bitcoin. The tweet itself is still on Twitter, garnering likes and drawing attention from Bitcoin enthusiasts around the world. Unfortunately, the passionate marathon runner Hal Finney was soon not able to run anymore.He died of amyotrophic lateral sclerosis (ALS) on August 28, 2014. In December 2022, Hal’s wife Fran Finney, started a charity event named “Running Bitcoin”. The initiative encourages people to run a half-marathon and help raise funds to fight ALS.

4. I mined block 70-something, and I was the recipient of the first bitcoin transaction when Satoshi sent ten coins to me as a test — I carried on an email conversation with Satoshi over the next few days, mostly me reporting bugs and him fixing them.

Hal Finney was the first person to support and help Satoshi Nakamoto. He also contributed code in 2008 and early 2009, before it was released to the public in January 2009. Hal also went down in history as the receiver of the first Bitcoin transaction, in which Satoshi Nakamoto sent him 10 BTC.

5. Bitcoin has a couple of things going for it: One is that it is distributed, with no single point of failure, no ‘mint’, no company with offices hat can be subpoenaed and arrested and shut down.

Hal Finney instantly liked the idea of Bitcoin, and probably worked on a similar concept years before Satoshi Nakamoto’s appearance: As an early pioneer of cryptocurrencies, he created Reusable Proof of Work (RPOW) in 2004, a system that allowed tamper-proof transactions to be reused by recipients. Finney’s RPOW is seen as a predecessor to Bitcoin, although it still used a central server instead of a decentralized network like Satoshi’s invention.

6. Since we’re all rich with bitcoins, or we will be once they’re worth a million dollars like everyone expects, we ought to put some of this unearned wealth to good use.

Hal wrote this in January 2011, when the price of 1 bitcoin was still less than $1. In a light-hearted, speculative conversation in the Bitcoin Talk forum, already saw a scenario for the bitcoin price to grow exponentially further – and that people already holding BTC and therefore profiting from the price increase should think of ways to spend their wealth wisely.

7. It’s pretty strange really that we all see a good chance that bitcoins will hit a dollar in the relatively near future. How many investments can be expected to triple in value in that time frame? Is gold going to be $3500 any time soon? Apple stock going to triple? Maybe Facebook, if you could get some. That seems like a pretty sure thing. We are really lucky to be in at the beginning of a possibly explosive new phenomenon. Considering the odds against most money-tripling investments, Bitcoin looks like a good place for a percentage of your portfolio.

Hal Finney expressed his excitement for bitcoin’s potential as an investment opportunity around 2010. He highlighted the rarity of investments capable of tripling in value quickly, comparing Bitcoin to traditional investments like gold, Apple, and Facebook stocks. Finney’s optimism and belief in Bitcoin’s disruptive power were shared by many early adopters, who saw it as a transformative force in the global financial landscape. In retrospect, his enthusiasm was well-founded, as Bitcoin’s value has grown exponentially since its infancy.

8. The danger is if people are buying bitcoins in the expectation that the price will go up, and the resulting increased demand is what is driving the price up. That is the definition of a BUBBLE, and as we all know, bubbles burst.

Hal sought to caution early Bitcoin enthusiasts about the potential formation of a bubble if people invested in the cryptocurrency solely based on the expectation of rising prices. At the time, Bitcoin was still in its nascent stage, and Finney aimed to encourage a focus on the technology’s underlying fundamentals rather than purely speculative investments. His warning remains relevant today, highlighting the importance of understanding short-term volatility.

9. I see Bitcoin as ultimately becoming a reserve currency for banks, playing much the same role as gold did in the early days of banking. Banks could issue digital cash with greater anonymity and lighter weight, more efficient transactions.

Hal Finney envisioned Bitcoin evolving into a reserve currency for banks, similar to gold’s role in the early days of banking. He highlights the potential benefits of digital cash, such as increased anonymity and more efficient transactions. Finney’s opinion suggests a forward-looking perspective on the potential of cryptocurrencies, emphasizing their ability to revolutionize the traditional financial system and offering a glimpse of the profound impact that digital assets like Bitcoin could have on global banking practices.

10. Ultimately it’s good for the network for mining to be expensive. It makes it that much harder for a well financed attacker to dominate the network.

Hal highlighted the importance of costly mining for the security of the Bitcoin network. It becomes more challenging for well-funded attackers to dominate and manipulate the network by making it expensive. Finney’s perspective underscores the value of maintaining a robust and decentralized cryptocurrency infrastructure, where high mining costs serve as a barrier to potential threats, ultimately contributing to the network’s long-term stability and resilience.

11. For Bitcoin to succeed and become secure, bitcoins must become vastly more expensive.

Hal emphasized the necessity for Bitcoin to increase in value to achieve long-term security and success. He understood that the economic incentives created by the currency’s increasing value would attract more miners to contribute their computational power to the network. This would bolster the security of the Bitcoin database by making it increasingly difficult for any single entity to take control. In the years since Finney’s statement, Bitcoin has appreciated substantially. It attracted widespread interest and validated his insight about the relationship between price and security.

12. The computational power of the network is proportional to difficulty; and it appears that difficulty is proportional to bitcoin price. It follows that unless bitcoins become substantially more valuable than they are today, the Bitcoin network will never be substantially more resistant to attack than it is today. For Bitcoin to succeed and become secure, bitcoins must become vastly more expensive.

Hal highlighted the relationship between Bitcoin’s network security, computational power, and market value. He posits that the network’s resistance to attacks is directly proportional to both the mining difficulty and Bitcoin’s price. In essence, for the network to become more secure, the value of Bitcoin must increase significantly. This creates a positive feedback loop, as a higher Bitcoin price attracts more miners. Increasing the computational power and mining difficulty and ultimately enhancing the network’s security.

Hal’s perspective underscores the importance of market value in the growth and long-term success of bitcoin.

We hope you liked this blog post about the top 12 Hal Finney quotes. For more quotes on Bitcoin, head to our blog post about the top 12 insightful Satoshi Nakamoto quotes.

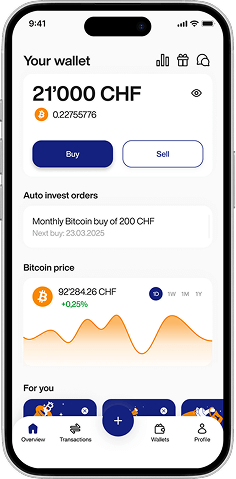

To start buying Bitcoin and experience our service, download the Relai app for Android or iOS.