Don’t worry. You are not alone. Bitcoin can be difficult to grasp at first.

To help you learn more about Bitcoin, we have written this guide to give you a deeper understanding of what Bitcoin is.

What is Bitcoin? The Quick Answer

Bitcoin is an open monetary network that enables anyone with an Internet connection to store, send, and receive money in digital form.

You can think of bitcoin as money for the Internet.

Bitcoin operates as a decentralized, peer-to-peer network maintained by voluntary participants scattered around the globe.

Unlike traditional currency, also known as fiat currency, Bitcoin operates free of government interference or central bank policy interventions, making it a “fairer” currency that is exclusively driven by supply and demand.

The History of Bitcoin

Bitcoin first appeared on a cypherpunk mailing list in October 2008, when a pseudonymous developer (or group of developers) named Satoshi Nakamoto published the Bitcoin whitepaper.

In the whitepaper, titled “Bitcoin: A Peer-to-Peer Electronic Cash System,” Nakamoto explained how a new type of digital money based on a proof-of-work protocol can be created to allow anyone in the world to send payments over the Internet.

On January 3, 2009, the genesis block of the Bitcoin blockchain was mined, marking the official launch of the Bitcoin network. A few days later, on January 12, the first bitcoin transaction took place when Satoshi Nakamoto sent bitcoin to renowned cypherpunk Hal Finney.

On May 22, 2010, early Bitcoin adopter Laszlo Hanyecz bought two pizzas for 10,000 BTC, which – as far as anyone knows – was the first commercial bitcoin transaction. Because the bitcoin he spent on the two pizzas would now be worth hundreds of millions of dollars, May 22 has become known as Bitcoin Pizza Day in the Bitcoin community.

In the same year, Bitcoin’s pseudonymous creator(s) Satoshi Nakamoto disappeared, handing control over the Bitcoin code repository over to developer Gavin Andresen.

In 2011 bitcoin started to trade on a handful of online bitcoin exchanges, enabling early adopters to see the price rise from less than one cent to reach price parity with the US dollar in April 2011. By June, one coin was worth $31.50.

In the same year, bitcoin experienced increasing adoption as a result of the infamous dark web marketplace Silk Road, which exclusively used bitcoin as a transactional currency. While Silk Road was an illegal operation that was eventually shut down by US authorities, it highlighted Bitcoin’s potential as money for the Internet that anyone could access and use.

In 2013, Bitcoin experienced its first massive rally when the price of the cryptocurrency shot up to hit $1,163 in November 2013, before correcting again in the following year and then cashing down to trade in the $100s in January 2015.

Chinese speculators were the rumored cause of the impressive 2013 bitcoin rally, which was then hampered when the Chinese government banned banks from dealing in bitcoin.

In 2016, the market recovered, and bitcoin “HODLers” had something to smile about again as the price steadily rose from mid-2016 to close the year out just under $1,000. In that period, “blockchain” became a buzzword, pushed by enterprises and financial institutions trialling Bitcoin’s underlying technology for other purposes.

2017 was a crazy year for Bitcoin as the price shot up from $1,000 in January to peak at over $20,000 in December. Combined with the fast-growing altcoin market, the ICO hype, and blockchain’s buzzword status, investors from all over piled into cryptocurrency.

From early 2018 until late 2019, Bitcoin experienced what became known as the “Crypto Winter” during which the price of bitcoin dropped to a low in the $3,000s while many altcoins lost 95%+ of their value. While Bitcoin opponents celebrated the apparent “demise of Bitcoin,” Bitcoin startups across the globe kept “BUIDLing,” driven by the belief that Bitcoin will become a success.

In 2020, despite the global pandemic, they were proven right. Not only did bitcoin shine as a store of value during times of global economic and political uncertainty, it also rallied substantially following the Bitcoin Halving, which reduces the rate of supply of newly mined BTC every four years.

2021 was arguably the best year Bitcoin has ever had. Not only did the price of the digital currency rally to never before seen highs over $60,000, the “magic internet money” also became legal tender in the Central American nation, El Salvador.

That’s right. Bitcoin is now a “real currency” used by millions of Salvadorans to accept and make payments and process remittances. Many argue that this is exactly what Satoshi had envisioned when he created Bitcoin. Global money for the people.

What is Bitcoin? The Long Answer

In its brief history, Bitcoin has evolved to serve several use cases, moving from a payment system for low-cost global payments to acting as a store of value during times of economic turmoil to becoming an officially recognized national currency.

Let’s have a look at the different use cases of Bitcoin to understand more about why the digital currency is considered such a valuable innovation.

Bitcoin is a digital payment system.

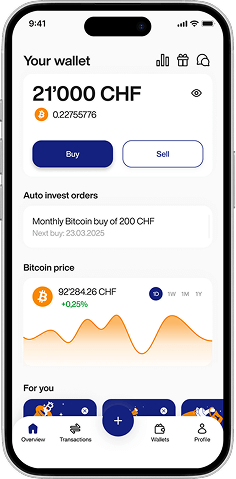

First and foremost, Bitcoin is a decentralized, peer-to-peer digital payment system that allows anyone to store and send money over the Internet. Regardless of where in the world you are located, if you have an internet connection and a smartphone, you can send money over the Bitcoin network.

Bitcoin is digital gold.

Bitcoin is also digital gold or gold 2.0. The reason for that is because it shares many of the precious metal’s core characteristics. Like gold, bitcoin is scarce, durable, portable, divisible, and has utility.

Unlike gold, however, you can send bitcoin across the globe for a few dollars and within minutes, making it a better version of gold. Hence the term, gold 2.0.

Bitcoin is freedom money.

Bitcoin is censorship-resistant money. What that means is that no bank or government can prevent you from accessing the Bitcoin network and using bitcoin to store value and send and receive payments.

Conversely, if you hold money in a bank, your funds can be frozen if the bank suspects any financial wrongdoing on your part. Moreover, a court could seize your assets, including all your money, should you end up in legal trouble. However, no one can access your bitcoin if you are holding them in a non-custodial wallet, like the Relai wallet.

Only the person who has access to your bitcoin wallet’s private keys can access your bitcoin. And that person should only ever be you.

Bitcoin is a hedge against inflation.

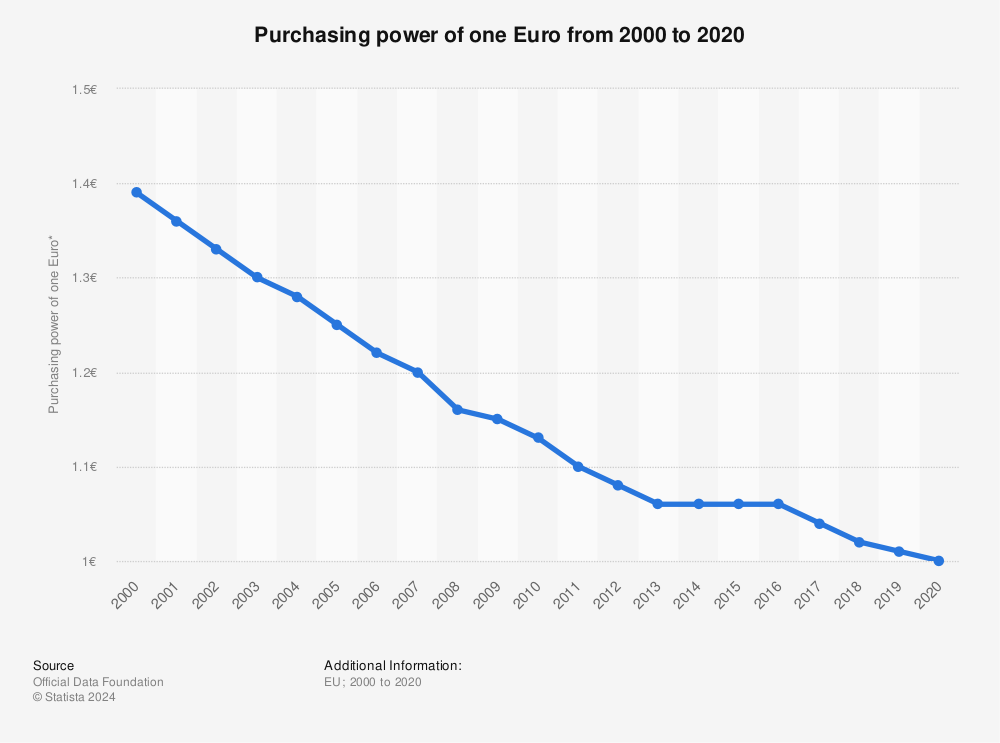

In today’s day and age, where central banks are printing money in an attempt to stimulate post-pandemic economic growth, inflation is skyrocketing. That means the prices of goods and services are increasing, making the money you hold in euros, pounds, and Swiss francs worth less.

Find more statistics at Statista

Fortunately, individuals can hold bitcoin as a hedge against inflation as the value of the cryptocurrency can not be debased by governments, nor can more bitcoin be printed.

There can only ever be 21 million bitcoin, and there is a hard-coded monetary policy combined with an economic incentive structure that determines how many coins can be mined and at what rate to ensure the supply of new coins slows down over time. As a result, bitcoin is a disinflationary currency.

The value of bitcoin has increased against all fiat currencies in the last ten years, whereas fiat currencies have lost purchasing power during the same time period due to inflation.

Bitcoin is a hedge against economic collapse.

In addition to functioning as a safe haven asset to protect wealth during times of excessive money printing and inflation, bitcoin also acts as a hedge against severe economic turmoil and a collapsing banking system.

While this may sound like a far-fetching scenario if you are located in Europe, you only need to ask the people of Cyprus who were not able to access their money held in bank accounts in 2013, when the Cypriot government decided to bail in depositors to save the nation’s banking sector from collapse.

Bitcoin is different things for different people. For some, it’s a speculative investment that they hope to get rich with, while for others, it’s a way to access the global economy.

Whatever bitcoin is for you, it’s probably worth owning some.

Takeaways:

- Bitcoin is multiple things at once: A decentralized, peer-to-peer payment network, a digital commodity that shares characteristics with physical gold, and a new form of censorship-resistant money that anyone with internet access can use.

- Over 4 billion people don’t have access to stable currencies and can use Bitcoin as an alternative to a financial system that doesn’t serve them.

- Bitcoin is useful for anyone who wants to use a global payment network and store of value that is neither run by a government nor by a company.

Disclaimer: Relai services are exclusively recommended for Swiss and Italian residents. None of this content constitutes investment advice. Always conduct your own research before investing in any digital asset.