Understanding the fundamental concept behind Unspent Transaction Outputs (UTXOs) is crucial for every Bitcoin investor – newbie and expert alike. In this blog post, we delve into what UTXOs are, why they matter to you as a Relai user, and show you practical, easy-to-implement strategies to manage them effectively.

What are Bitcoin UTXOs?

Unspent Transaction Outputs, or UTXOs, are essentially the building blocks of a Bitcoin transaction. Imagine Bitcoin as the digital version of good old cash. When you receive Bitcoins, you essentially get ‘digital change’ back. This ‘change’ is what we refer to as UTXOs. Each Bitcoin transaction starts with coins used to balance the ledger. UTXOs are identified as the outputs of previous transactions and serve as inputs for new transactions. So if you previously received 2 BTC and want to send 1 BTC to someone, your transaction will use the 2 BTC UTXO as an input, send 1 BTC to the recipient, and return the remaining 1 BTC as a new UTXO to your wallet.

Still too complicated? Imagine you have a piggy bank full of different coins, and each coin represents a fraction of the total Bitcoin you own. These individual coins are like UTXOs in the Bitcoin world. When you want to buy something with your Bitcoin, you must break open your piggy bank and use some of your coins. Suppose you have a 2-Bitcoin coin (or UTXO) and want to buy something that costs 1 Bitcoin. You can’t break the coin into smaller pieces, so you use the whole 2-Bitcoin coin. The person you’re buying from gives you the thing you want and 1 Bitcoin as a change. This change is another UTXO in the Bitcoin world, returning to your virtual piggy bank. So every time you make a transaction, you take out these virtual coins, use some for the transaction, and put the change back as new coins. These new coins are your new UTXOs, waiting to be spent in your next transaction.

As you just learned, the crucial part is that it’s important to keep track of UTXOs because they are like your remaining balance. But unlike a bank that tells you your total balance in one number, in Bitcoin, you have to add up all these little pieces (UTXOs) to know how much you have. Let’s look closer at how this works.

The Problem With Small Unspent UTXOs

Dealing with small Unspent Transaction Outputs (UTXOs) in Bitcoin can present several challenges. One major issue is the increase in transaction fees. Since each UTXO contributes to the overall data size of a transaction, using many small UTXOs can lead to a larger transaction, which typically attracts higher fees on the Bitcoin network. This is particularly noticeable when you’re trying to spend a significant amount, as the transaction will require many small UTXOs, increasing its size and, consequently, the fee.

Moreover, the complexity of transactions can also increase with numerous small UTXOs. The Bitcoin network processes each UTXO individually, so a transaction composed of many small UTXOs can be slower, especially during high network congestion. This complexity can also impact the performance of your Bitcoin wallet. Some wallets may experience slowdowns or other performance issues when handling many small UTXOs, as they need to track and update these fragments of Bitcoin continuously.

Privacy concerns are another pitfall associated with small UTXOs. Using many of them in a single transaction could reveal more about your spending patterns and the history of your wallet’s transactions. Since each UTXO carries its own history, aggregating many in one transaction can inadvertently expose transactional patterns.

Additionally, small UTXOs can make your wallet more vulnerable to dusting attacks. These attacks involve sending minuscule amounts of Bitcoin to numerous addresses to track their transactions. A wallet with many small UTXOs might find it more challenging to identify and safeguard against such malicious activities.

In summary, while small UTXOs are a natural part of Bitcoin’s functioning, their management requires careful consideration to avoid increased fees, transaction complexities, performance issues in wallets, potential privacy breaches, and susceptibility to dusting attacks.

Why do UTXOs matter to me as a Relai user?

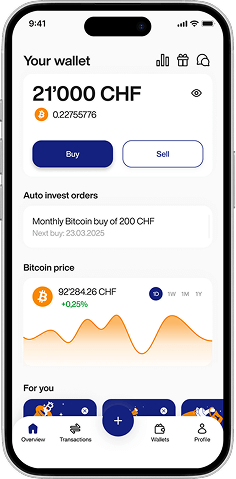

As a user of Relai, understanding the basic technical concepts behind UTXOs is particularly beneficial. Relai, being a non-custodial wallet and a Bitcoin broker, offers you full control over your Bitcoin transactions and investments. This autonomy means you’re directly handling UTXOs whenever you execute transactions. Whether you’re setting up a savings plan starting from as little as 10 EUR/CHF, buying Bitcoin to store in your Relai wallet, or transferring your assets to a hardware wallet, each action involves UTXOs.

By grasping how UTXOs work, you can better manage your transaction fees, enhance the security of your Bitcoin holdings, and optimize your overall Bitcoin investment strategy. This knowledge is invaluable, especially in an app like Relai where simplicity and user control are paramount. Understanding UTXOs in this context ensures that you’re not just passively investing in Bitcoin, but actively managing your digital assets in a way that aligns with your financial goals and security preferences.

How to Manage UTXOs Effectively

Consider implementing a few strategic practices to avoid the pitfalls associated with small UTXOs.

- Be mindful of the frequency of your transactions; frequent, small transactions can lead to a proliferation of tiny UTXOs, which are not cost-effective to spend due to higher transaction fees. Instead, aim for fewer, larger transactions.

- Utilize a wallet that supports UTXO management, allowing you to consolidate these smaller UTXOs during periods of low network congestion, thereby reducing fees.

- When setting up a savings plan, such as those offered by Relai, consider consolidating your regular investments into a single, larger transaction to minimize the creation of small UTXOs. This approach not only streamlines your Bitcoin holdings but also makes future transactions more economical and easier to manage. By being proactive and strategic about your transaction habits and UTXO management, you can significantly mitigate issues associated with small UTXOs, leading to a more streamlined and cost-effective Bitcoin investment experience.

Conclusion

UTXOs may seem like a technical detail, but they are a vital part of how Bitcoin functions. Proper management of UTXOs can lead to enhanced security, improved privacy, and cost savings. By understanding and effectively managing your UTXOs, you are not just protecting your assets but also contributing to the overall health and efficiency of the Bitcoin network.

FAQs

What happens to UTXOs in a transaction?

In a transaction, UTXOs are spent and new UTXOs are created as ‘change’ if the input exceeds the amount being sent.

Can UTXOs be merged or split?

Yes, UTXOs can be merged in a single transaction or split into multiple UTXOs, depending on the transaction requirements.

How do I check my UTXOs?

Most Bitcoin wallets provide a way to view your UTXOs, often in an advanced or detailed section of the wallet.