You may have heard that you should only invest money you don’t need. But to take advantage of this wise advice, you first need to find out how much you earn and how much you spend. This is where budgeting comes in.

In this lesson of the Relai Bitcoin Basics, you will learn what a household budget is, how to keep track of your income and expenses, and how to use this knowledge to become a better, more relaxed investor.

What is a household budget?

Simply put, a household budget is a breakdown of your regular expenses and income. That’s it. So in its simplest form, it can be a table with two columns where you enter how much money you make each month and how much you spend.

Income for most people will be the regular salary from their employers. However, you may have a part-time job, sell something on the Internet, or receive extra money from rent, dividends, or government assistance. Your income is made up of all of these. Of course, you should not forget that you must pay taxes on some of your income. So at the end of the day, your real income is after-tax income.

| INCOME | EXPENSES |

| Salary | Rent |

| Side hustle | Utilities |

| Rent Income | Transportation (Car, Public Transport) |

| Additional Income (Investments, Pensions, etc.) | Loan Payments |

| … | Groceries |

| … | Clothes |

| … | Internet and Phone |

| … | … |

How do I keep track of my expenses?

Keeping track of your income streams is pretty easy, as it is most likely just your salary. However, keeping track of your expenses can be tricky. There is no one solution in this regard, but a range of options should be as little disruption as possible for you in your everyday life.

- Write everything down manually – on paper or in an Excel sheet

This might seem a bit too old-school, but hear us out. The most straightforward option is to sit down once a week or month and write down how much money you spent on what. You can use a sheet of paper each month or create an Excel / Google Sheet. For this to work, you need to keep the receipts when you go shopping and ensure that you don’t lose them if you pay cash. If you pay digitally, you can check your bank statements to keep track of all transactions.

- Use a household budgeting app

Of course, there are countless apps for this very purpose. Ultimately, they offer you exactly the same as the option above: to record all your income and expenses. Conveniently, these apps look nice and are much more user-friendly than an Excel spreadsheet, for example, and often also offer automation options that allow you to save regular income and expenses, for example.

- Use your banking app (if it supports it)

This option highly depends on where you live and the choice of banks available in your country. For example, the German online bank N26 is a viable choice in many European countries. It offers a free account and an automatic overview of your income and expenses, sorted by categories like ‘Food & Groceries’, ‘Bars & Restaurants’, ‘Transportation & Car’ or ‘Media & Electronics’. Note that there are many alternatives and maybe your existing bank account already offers something like this.

What do I do now that I have a household budget?

First, it gives you a good feeling to know roughly how much you spend and earn each month. The point is not to count every cent but to get a rough picture of your situation. This is especially useful if you earn little, are still studying, or have children. The goal should not be particularly stingy from now on or constantly worrying about whether you can afford this and that. On the contrary, once you’ve kept a (rough) household budget for a few weeks or even months, you’ll get a feel for whether all your expenses are necessary.

Now it’s time to decide whether and how much money you have left over at the end of the month you want to save or invest. There is no right or wrong amount, it is only important that it should not be too much for you and your situation. You shouldn’t get nervous when your investments go down (especially important with a volatile asset like Bitcoin) and you shouldn’t be forced to sell at a current price because you need money urgently.

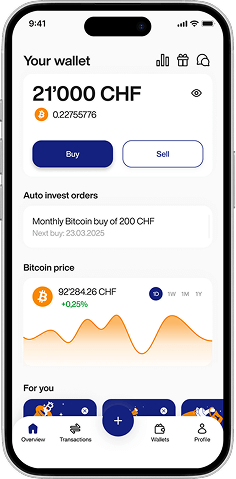

At Relai, for example, you can buy bitcoin for as little as 10 euros a month. If you regularly buy via an auto-invest plan, you save fees and don’t have to worry about anything.

Takeaways:

- A household budget is a breakdown of your regular expenses and income. That’s it. So in its simplest form, it can be a table with two columns where you enter how much money you make each month and how much you spend.

- There is no one solution to keeping track of your expenses. You can use paper and pencil, an excel spreadsheet, or an app.

- The goal is to determine if and how much money you have left at the end of the month and how much you want to save or invest.

Disclaimer: Relai services are exclusively recommended for Swiss and Italian residents. None of this content constitutes investment advice. Always conduct your own research before investing in any digital asset.