In this guide, you will learn what dollar-cost averaging is, how it works, and how you can use Relai to DCA bitcoin.

Before we explain the details, let’s look at how you can auto-DCA bitcoin using Europe’s easiest bitcoin investing app, Relai.

How to auto invest in Bitcoin Using Relai

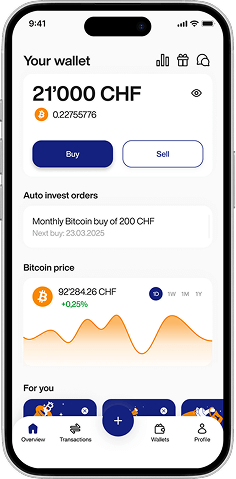

Arguably the easiest way to dollar-cost average bitcoin is by setting up an automated bitcoin savings plan with Relai.

To start auto-investing in bitcoin within minutes, you need to follow these steps:

- Download the app from the App Store or Google Play Store.

- Go on the “Buy Bitcoin” dashboard in the app.

- Type in the amount you would like to purchase (in EUR or CHF).

- Decide whether you want to DCA bitcoin on a weekly or monthly basis.

- Follow the instructions for the recurring bank transfer you need to set up on your bank account.

- Input the payment information into your banking app and set up the recurring payment to Relai. You don’t need to put a transaction reference as Relai knows that the payment is coming from you from your IBAN.

And that’s it!

What Is Dollar-Cost Averaging?

Dollar-cost averaging is an investment strategy that involves buying a fixed dollar (or euro or Swiss franc) amount of an asset at regular intervals over a long period of time.

The main concept behind dollar-cost averaging is to “smooth out” volatility by investing a fixed dollar amount at the same time each week (or month) regardless of where the price of the asset is trading.

Additionally, it allows investors to build a sizeable position in an asset or a basket of assets without having to put a large amount of initial capital down.

What’s more, it allows investors to benefit from compounding as returns on the initial investment and on the weekly (or monthly) investments compound to increase returns over time.

Example:

You could invest €50 every week into an ETF that tracks the DAX Index to gain exposure to the performance of Germany’s stock market. In addition to the €50 you are investing every week (which pile up as savings), you will earn returns on your investment as the German stock market’s value increases over time.

Your portfolio will grow because; you invest €50 every week, you will earn returns on the funds you invest (as the DAX Index increases over time), and you will earn returns on your returns as you reinvest your earnings.

Wall Street Also Likes Dollar-Cost Averaging

While dollar-cost averaging may sound like a strategy only reserved for small investors, that’s not the case. Several seasoned Wall Street investors believe in dollar-cost averaging as a sound investment approach.

For example, renowned investor and father of ‘Value Investing,’ Benjamin Graham, stated:

“[Dollar-cost averaging] has worked extremely well for those who have had the money, the time and, the character necessary to pursue a consistent policy over the years regardless of whether the market has been going up or down. If you can do that, you are guaranteed satisfactory results in your investments.”

Graham’s star protégé, Warren Buffet, is also a fan of this passive investing approach. He said:

“If you like spending six to eight hours per week working on investments, do it. If you don’t, then dollar-cost average into index funds.”

While dollar-cost averaging can be applied to all sorts of assets, the investment asset arguably the most suited for this strategy is bitcoin.

So let’s talk about the benefits of dollar-cost averaging into bitcoin.

The Benefits of Dollar-Cost Averaging Bitcoin

Bitcoin DCA has become one of the most popular investment strategies among seasoned bitcoiners.

By buying a specific amount every week or month, bitcoin believers build sizeable positions in an asset that they believe will multiply in value in the coming years.

Regardless of whether or not you believe that the price of bitcoin will go “to the moon” (as the popular bitcoin meme suggests), bitcoin has been the best-performing asset of the last decade. Many experts agree that it has a place in a diversified portfolio.

The three main benefits of dollar-cost averaging bitcoin are:

- Takes market volatility out of the equation

- Allows anyone – even small investors – to start investing in bitcoin

- Increases returns thanks to compounding

Takes market volatility out of the equation

Anyone who has been following bitcoin for a while knows that you are regularly in for a ride. It’s not uncommon for bitcoin’s price to drop five or more percent in a day. That makes it incredibly difficult to “time the market” as a bitcoin buyer, creating a strong argument for dollar-cost averaging bitcoin.

When you DCA bitcoin, you buy a fixed amount each week or month regardless of the price. As a result, you will be able to “smooth out” market volatility as you will catch some lows and some highs. But your overall price entry-level will average out the price volatility.

Allows anyone to start investing in bitcoin

Buying a small amount of bitcoin on a regular basis – ideally in an automated manner – allows even small investors with little capital to start building a sizable position in bitcoin.

There is a misconception among first-time investors that they “need money to make money” in the financial markets. Thanks to dollar-cost averaging and bitcoin, that is not the case.

By “stacking sats” (i.e., buying small amounts of bitcoin) at regular intervals, anyone can invest in bitcoin and (potentially) earn a handsome return on investment over time.

Increases returns thanks to compounding

When you dollar-cost average, you earn returns on your initial investment and on each additional investment you make (provided the asset or basket of assets increases in value over time).

What’s more, you also earn returns on the returns you have generated as they are typically reinvested automatically.

Still not convinced about dollar-cost averaging bitcoin? Then let’s have a look at how this strategy has performed in the past.

Historical Bitcoin DCA Returns

When it comes to investing, what people really care about the most are returns. So let’s look at how historical Bitcoin DCA returns to see how this strategy has performed in the past.

If you would have invested €50 in bitcoin every week for the last three years, you would have a bitcoin investment worth almost €50,000 today.

If you would have invested the same amount each week for the last five years, your €50 a week investment would now be worth over €165,000.

Finally, if you would have been very bullish on bitcoin and would have invested €275 each week for five years, your bitcoin holdings would now be worth almost one million euros.

In the last five years, we experienced an aggressive bitcoin rally and a deep market correction. So despite the high volatility, dollar-cost averaging bitcoin generated a substantial return on investment.

While past returns do not predict future performance, looking at the historical performance of dollar-cost averaging bitcoin provides us with insight into how this strategy performs during a period that includes both a bull and a bear market. Also, it allows us to gauge how dollar-cost averaging performs versus a buy & hold strategy.

You are now set up to dollar-cost average into bitcoin at weekly or monthly intervals. Click here to start investing in bitcoin with Relai.