BITCOIN

PRICE

The Bitcoin price is one of the most discussed numbers in the world of cryptocurrencies. Here, you will find out everything you need to know about the Bitcoin price, its development, and the most important influencing factors.

Why you should buy Bitcoin from Relai

Swiss made

A trusted app developed in Switzerland

Bitcoin only

Focused exclusively on Bitcoin

Self Custody

Full control of your BTC with a non-custodial wallet

The most important facts about Bitcoin

Bitcoin is not only the first cryptocurrency but also the best-known and most widely used. Since its launch in 2009, Bitcoin has undergone an impressive evolution, marked by both ups and downs. These milestones demonstrate the unique and dynamic nature of the digital currency.

| 2009 | Bitcoin was officially launched after Satoshi Nakamoto published the Bitcoin Whitepaper in October 2008. The first transactions take place among early developers and enthusiasts. |

| 2010 | On May 22, Laszlo Hanyecz paid 10,000 BTC for two pizzas, the first known commercial transaction using Bitcoin. The day is now celebrated as “Bitcoin Pizza Day”. |

| 2011 | Bitcoin reached parity with the US dollar for the first time, and the first major exchange hack (Mt. Gox) highlighted the risks of early infrastructure. |

| 2012 | Bitcoin experienced its first halving, reducing mining rewards from 50 to 25 BTC, and WordPress became one of the first major platforms to accept Bitcoin payments. |

| 2013 | Bitcoin broke $1,000 per BTC for the first time, indicating growing public interest. |

| 2017 | The price reached $19,666 per BTC, driven by cryptocurrency hype, before crashing again. |

| 2018 | After the hype, the price dropped below $3,000, illustrating the market’s volatility. |

| 2019 | Bitcoin rebounded to nearly $14,000 mid-year amid growing institutional infrastructure, before settling around $7,200. |

| 2020 | Despite a pandemic-induced crash in March, Bitcoin surged past $29,000 by December as institutional investors, such as MicroStrategy, entered the market. |

| 2021 | Bitcoin hit an all-time high of $69,045, driven by institutional investment and broader adoption. |

| 2022 | The price fell below $20,000 again but stabilized by the end of the year. |

| 2023 | A period of recovery and stability, with Bitcoin continuing to be viewed as digital gold. |

| 2024 | Bitcoin reached a new all-time high of over $108,000, driven by institutional investment and positive market sentiment. |

What is Bitcoin?

Bitcoin is the first and most famous cryptocurrency, created in 2009 by an anonymous person or group under the pseudonym Satoshi Nakamoto. It is a digital currency that works independently of central institutions such as banks or governments. Bitcoin is based on a decentralized network that ensures security, transparency, and traceability.

The key features of Bitcoin:

Decentralization:

Bitcoin is not controlled by a central authority. Instead, it is based on a peer-to-peer network in which all participants act on equal terms. Transactions are validated and stored by computers (nodes) worldwide, making manipulation almost impossible.

Blockchain technology:

Bitcoin transactions are stored on the blockchain, a public, decentralized ledger. Every transaction is secured and permanently stored using a cryptographic process. This ensures a high level of transparency and security.

Limited Offer:

Unlike fiat currencies, which can be printed indefinitely by central banks, the maximum amount of Bitcoin is up to 21 million coins limited. This limited supply makes Bitcoin a scarce digital asset, comparable to gold.

Independence from traditional financial systems:

Bitcoin was created as an alternative to traditional financial systems, especially for people living in countries with unstable currencies or limited access to banks. It offers the ability to store and transfer value without middlemen.

Security and pseudonymity:

Bitcoin transactions are secure and pseudonymous. Although all transactions are publicly stored on the blockchain, users’ identities are protected by cryptographic keys, making it challenging to link wallet addresses to real-world identities without additional information.

Global reach:

Bitcoin knows no geographical boundaries and can be sent worldwide in minutes. This makes it an ideal solution for international payments, especially in regions with high transaction costs at traditional banks.

Store of value:

Many consider Bitcoin a form of “digital gold” because it offers a way to store value over the long term, especially during times of inflation or economic uncertainty.

How does Bitcoin work?

Mining

New Bitcoins are created through a process called mining. Miners use specialized hardware to compute cryptographic hashes, searching for one that meets Bitcoin’s current difficulty target. This validates transactions and adds new blocks to the blockchain. For this work, miners receive Bitcoin as a reward.

Global reach:

Users can send and receive Bitcoin using a digital wallet. Every transaction is verified by a network of computers and stored on the blockchain. This ensures trust without the need for a middleman, such as a bank.

Halving:

Approximately every four years, the reward for miners halves, reducing the supply of new Bitcoins. This so-called Halving often has an impact on the price of Bitcoin as it increases scarcity.

Why was Bitcoin developed?

Bitcoin was created at a time when many people had lost trust in the traditional financial system – particularly after the global financial crisis of 2008. The vision behind Bitcoin was to create a system that:

- Works independently of banks and governments,

- is secure, transparent and tamper-proof,

- Offers people around the world an opportunity to transfer value without restrictions.

What is Bitcoin used for?

Means of payment

Bitcoin is being accepted by an increasing number of merchants and businesses worldwide, both online and offline. It can be used for everything from small purchases to large transfers.

Investment

Many people buy Bitcoin as a speculative asset or long-term investment, hoping for further appreciation.

Hedging against inflation

In countries with unstable currencies, Bitcoin is often used as a safe-haven asset to protect individuals’ wealth.

What makes Bitcoin unique?

Bitcoin is more than just a digital currency – it is a technological revolution. It has laid the foundation for a new era of cryptocurrencies and decentralized systems that have fundamentally changed traditional finance and the way we transfer value.

Why do people invest in Bitcoin?

Store of value

Like gold, Bitcoin is often viewed as a hedge against inflation because its supply is limited.

High return

Despite its volatility, Bitcoin has shown impressive appreciation over the past decade.

Diversification

As an asset class, Bitcoin offers a way to diversify a portfolio and spread risk.

Long-term potential

Many believe that Bitcoin will continue to increase in value in the long term as adoption increases worldwide.

What influences the Bitcoin price?

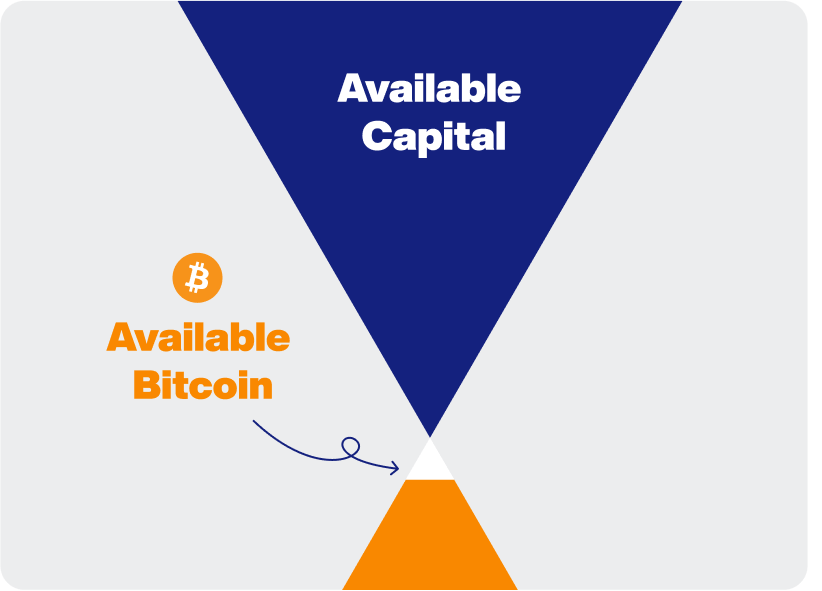

The interplay of supply and demand determines the Bitcoin price and is heavily influenced by activity on global cryptocurrency exchanges. Since there is no central institution that controls the price, the price is determined solely by market forces. Various factors play a crucial role in pricing.

Firstly, the price of Bitcoin is determined by the dynamics between buyers and sellers. When more people want to buy Bitcoin than there are for sale, the price rises. Conversely, an oversupply of Bitcoin or lower demand leads to a drop in price. This makes the market extremely volatile and prone to rapid price movements.

Another important influencing factor is this limited supply of Bitcoin. There will only be 21 million Bitcoins in total, a characteristic that makes Bitcoin a scarce digital asset. This artificial limit ensures that Bitcoin’s value increases as demand rises, since its supply cannot be expanded – a key difference from fiat currencies, whose supply can be increased at will by central banks.

Since Bitcoin is traded on numerous exchanges worldwide, there is no uniform reference price. Each exchange has its own rate, which depends on factors such as trading volume and liquidity. Aggregated data from platforms such as CoinMarketCap or TradingView provide average values, but slight price deviations between exchanges are common.

Additionally, marketplace intermediaries and fees impact pricing. Many platforms charge transaction fees, which affect the final price for buyers and sellers. Arbitrage, i.e., trading between different exchanges, can also compensate for smaller price differences.

In summary, the Bitcoin price is driven by a complex interplay of scarcity, demand, trading activity, and external costs. These mechanisms make Bitcoin unique but also vulnerable to price fluctuations.

Should you still buy Bitcoin now?

Despite its volatility, Bitcoin has proven to be one of the best-performing asset classes in recent years. However, you should make a few considerations:

Long-term focus

Bitcoin is being accepted by an increasing number of merchants and businesses worldwide, both online and offline. It can be used for everything from small purchases to large transfers.

Diversification

Many people buy Bitcoin as a speculative asset or long-term investment, hoping for further appreciation.

Risk management

In countries with unstable currencies, Bitcoin is often used as a safe haven to protect savers from losing their wealth due to currency debasement.

FAQ

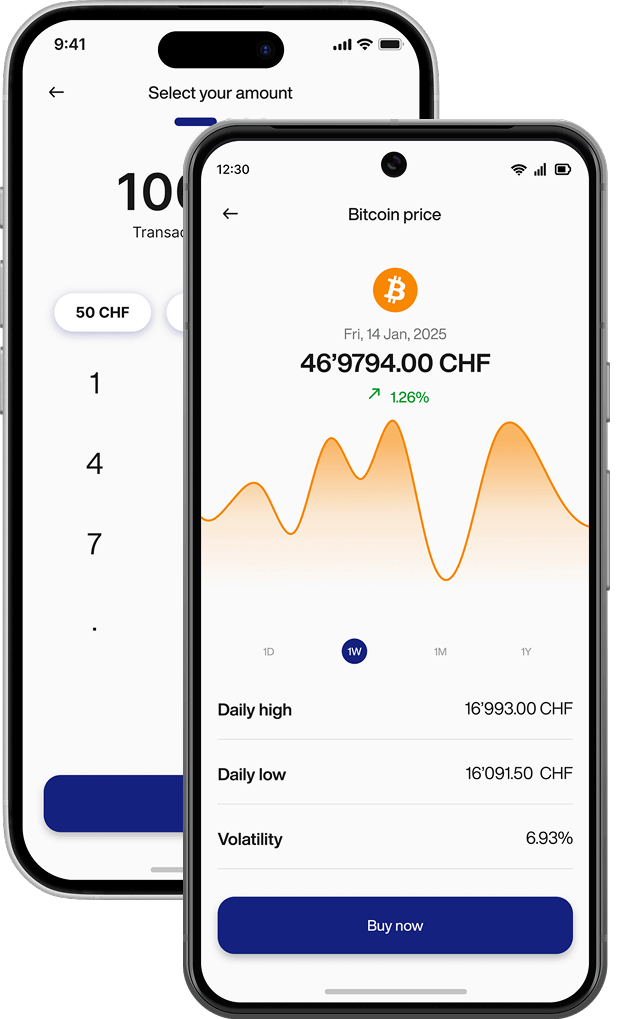

Relai is for everyone who wants to buy and sell Bitcoin, starting with as little as 50 EUR/CHF via our mobile app.

Relai Private is for individuals who want to trade beyond our default limits. Relai Private clients can buy or sell larger amounts of more than 100,000 EUR/CHF with exclusive personal service and expert guidance.

Relai Business is for small to medium-sized businesses who want to add Bitcoin to their corporate balance sheets of more than 20,000 EUR/CHF per transaction with exclusive personal service and expert guidance.

Our transparent and competitive fee structure lets you get more bitcoin in your wallet.

Zero fees on your first monthly auto-invest plan up to 100 CHF/€ – that’s up to 1,200 CHF/€ a year!

Start buying bitcoin from just 50 CHF/€

By adding an invite code, you can reduce their fees from the initial 1 % to the final fee of 0.9 % for orders up to 100,000 CHF/€ per transaction.

Credit card, Apple Pay, and Google Pay payments incur an additional fee of 3.0% per transaction.

Relai offers a self-custodial wallet – which means we never hold your Bitcoin for you. Instead, your Bitcoin goes straight into a wallet that only you can access. Not us. Not anyone else. When you create your wallet in the app, you’ll get something called a recovery phrase – a secret backup that proves ownership. As long as you keep that phrase safe, your bitcoin is always yours.

To buy bitcoin with Relai, start by downloading the app from the App Store or Google Play. Tap the ( + ) button and choose ‘Buy’. Enter the amount you want, then select whether it’s a one-time purchase or a recurring plan (weekly or monthly). Pick your payment method — either bank transfer or use a credit/debit card, Apple Pay, or Google Pay for instant purchases.

You can also add a referral code to save on fees and choose to send bitcoin directly to an external wallet. Finally, review your order and confirm it.