Take Part in Our Halving Giveaway!

Become a Bitcoin Millionaire by taking part in our Halving Giveaway!… Read more

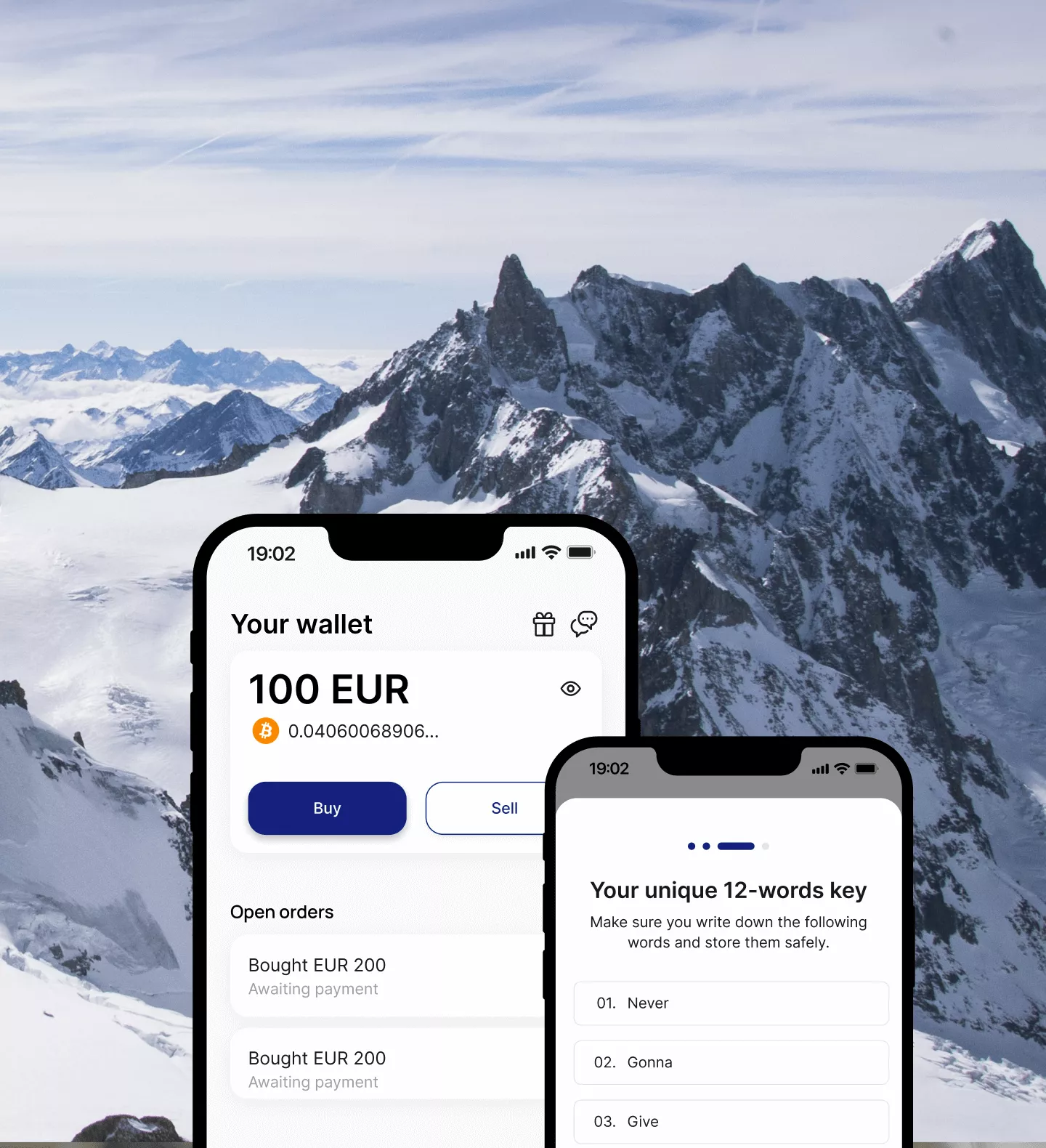

Buy Bitcoin instantly and hold your own keys with ease and simplicity. Join 100,000 others using Relai and start your Bitcoin journey.

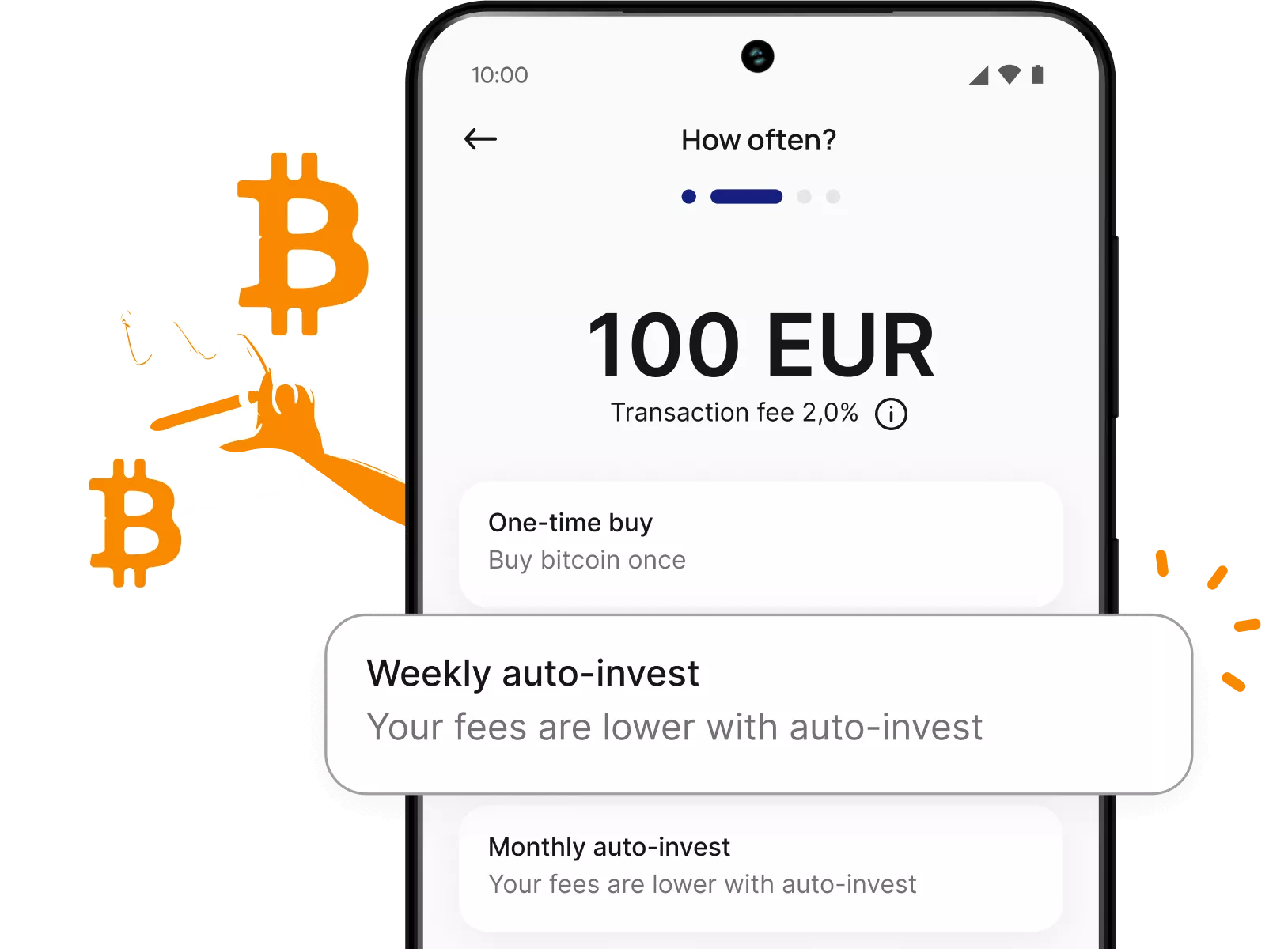

Input the amount of money you want to invest. You can start with as little as 25 EUR/CHF and go all the way up to 1’000 CHF per day and 100’000 CHF per year.

Select how often you want to purchase Bitcoin. Make a single buy or set up a weekly or monthly auto-invest plan.

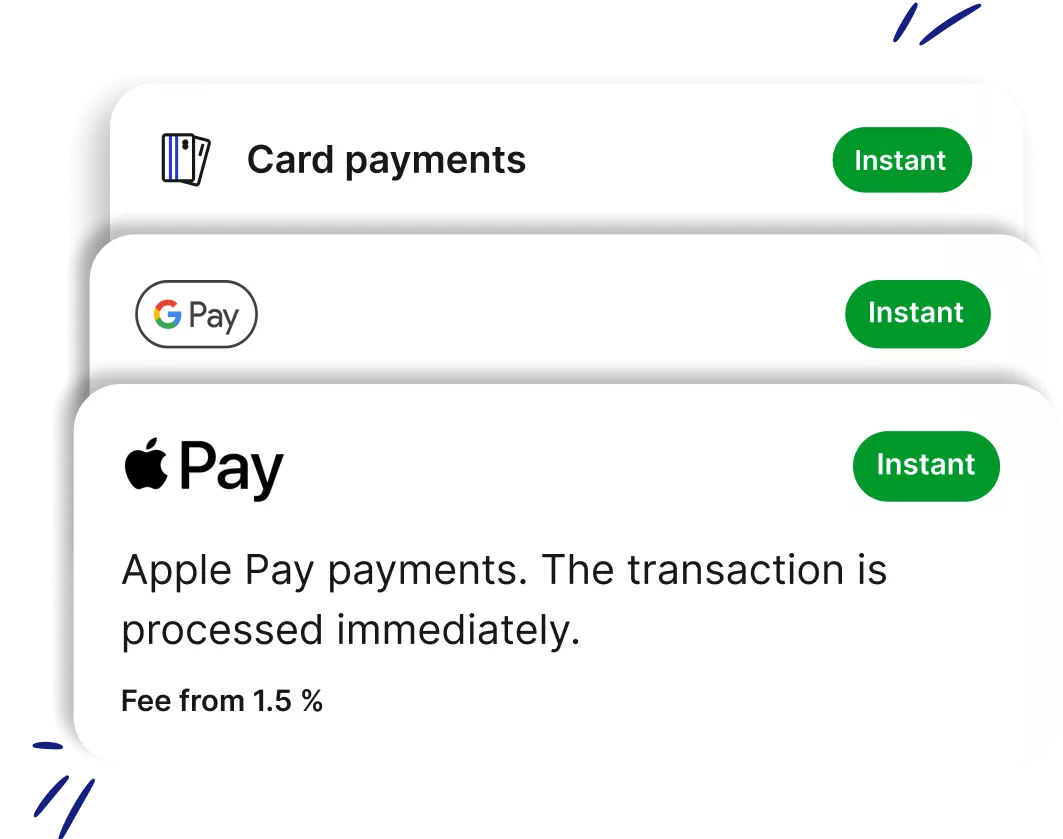

Pick out of bank transfer, credit, or debit card as well as Apple Pay or Google Pay.

Go to your banking app and create a bank transfer if you chose bank transfer. Finish the payment if you picked a different method. Make sure to add your referral code (if you have one).

Relai offers a solution for both beginners and experts

Yes, that’s right: You can buy Bitcoin with 0% fees. Once a month, up to 100 EUR/CHF per order.

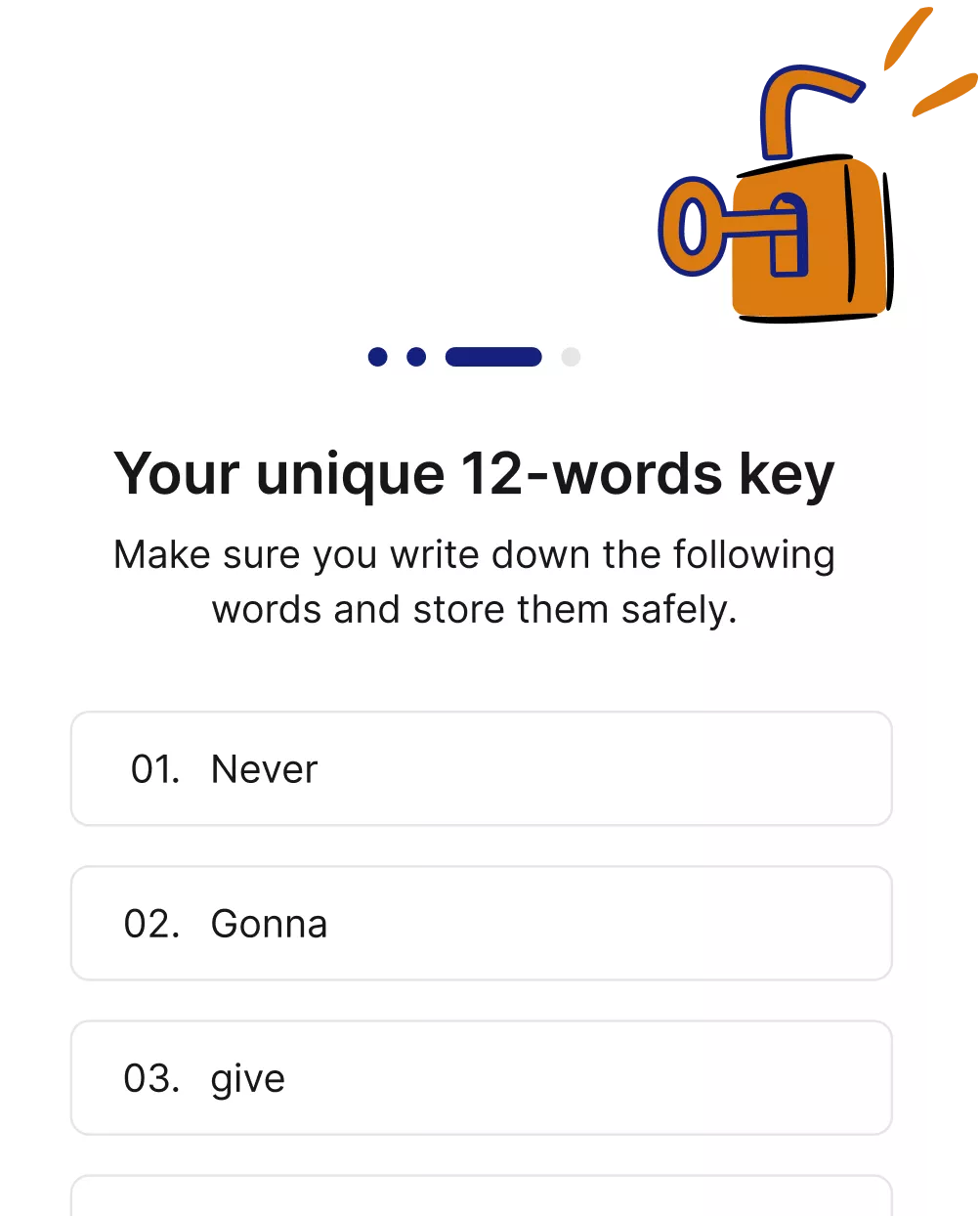

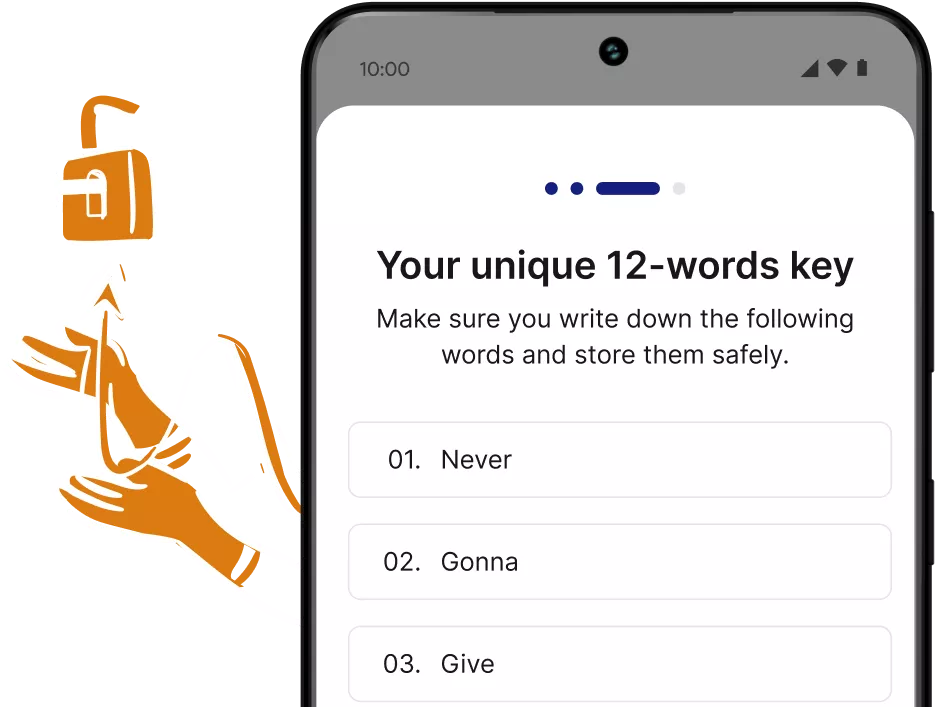

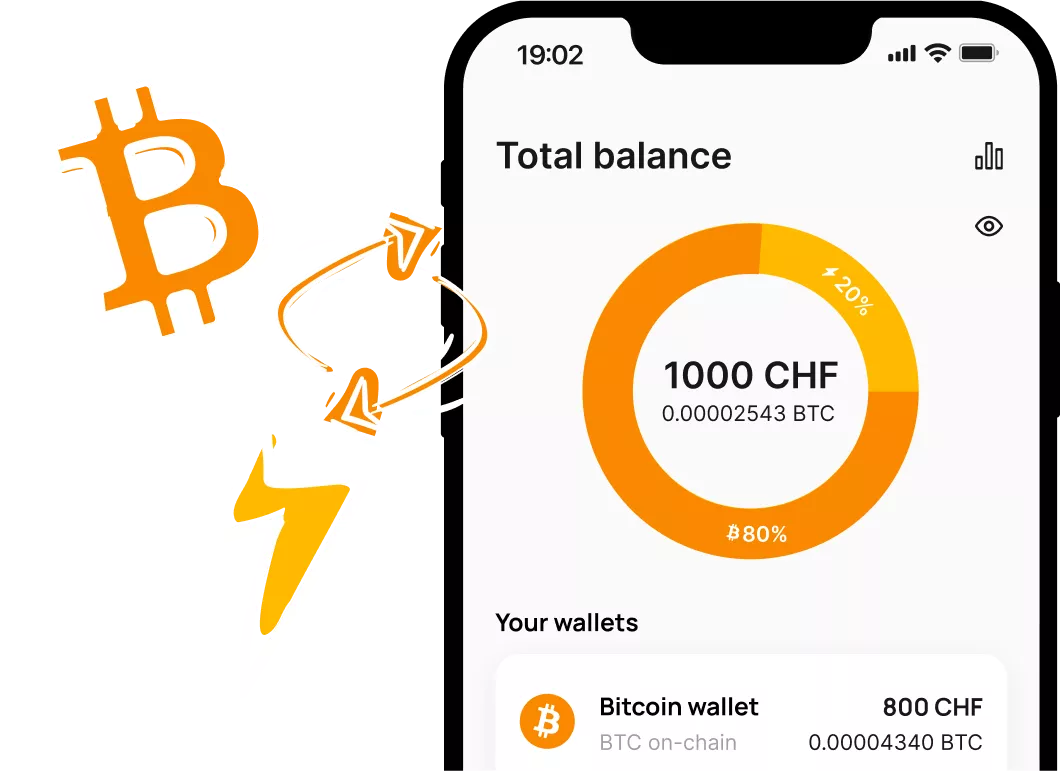

The Relai app comes with a non-custodial Bitcoin wallet. This gives you, and only you, total control of your Bitcoin.

Buy Bitcoin using EUR or CHF without registration. Choose from a wide range of payment options.

Buy Bitcoin automatically every week or every month without the stress of timing the market.

Invite your friends to Relai – they will save 20% on fees, you receive up to 50% revenue share, paid in Bitcoin!

The Relai app has now non-custodial Lightning enabled in the wallet. This allows you to send transactions at the speed of light with very little cost.

Become a Bitcoin Millionaire by taking part in our Halving Giveaway!… Read more

We’ve enabled the Lightning Network in the Relai App a few weeks back. Here’s how it went!… Read more

We’ve been adding Bitcoin to our balance sheet since January 2024. Find out why we decided to and what we plan with it. Read more

Relai is an SRO member (Self Regulatory Organisation) of VQF (Verein Qualitätssicherung Finanzwesen). Relai is a Swiss licensed financial service provider are fully compliant with Switzerland’s Anti-Money Laundering Act.

Please select your preferred language